Accountants enter 2026 downbeat on global economic prospects

Accountants enter 2026 downbeat on global economic prospects

Finance professionals are entering 2026 with a cautious outlook as global economic momentum shows signs of easing, according to the latest Global Economic Conditions Survey conducted jointly by the Association of Chartered Certified Accountants (ACCA) and the Institute of Management Accountants (IMA).

The quarterly survey of nearly 1,200 accountants and finance professionals, released in mid-January, shows that global confidence remained weak at the end of 2025, with the Global New Orders Index falling for a third consecutive quarter to its lowest level since the pandemic. While the index remains well above crisis-era lows, the decline raises the risk of some moderation in global growth in the year ahead.

Confidence among chief financial officers improved slightly but stayed below its historical average, with key indicators pointing to continued caution in corporate decision-making. Employment and capital expenditure intentions remained weak, reflecting a restrained outlook across many firms.

Asia-Pacific stood out as a relative bright spot. Regional confidence rose again in the fourth quarter to its highest level since Q2 of 2024. While the forward-looking New Orders Index edged down, it remained above its long-term average. Capital expenditure increased for the third consecutive quarter and reached its highest level since Q3 of 2024. Employment also ticked up, although it continued to sit below average.

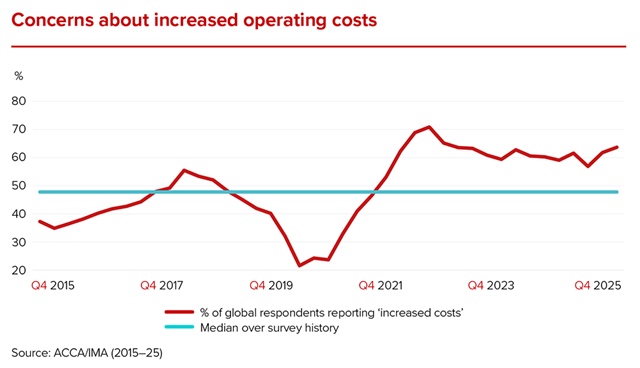

Cost pressures in the region eased further, with the share of respondents reporting rising operating costs slipping just below the series average. This suggests some additional room for central banks to ease monetary policy.

|

Against a backdrop of higher US import tariffs, the overall results for Asia-Pacific were described as encouraging, supported by global economic resilience, reduced trade policy uncertainty, and strong AI-related exports. However, the survey warned that further trade restrictions, sharper-than-expected slowdowns in the US or China, or weaker global investment in AI could pose risks in 2026.

Jonathan Ashworth, chief economist at ACCA, told VIR that accountants were entering 2026 with caution amid an uncertain global environment.

“The global economy performed better than expected in 2025 and looks set to remain resilient in 2026, supported by recent monetary easing by central banks, stock market gains, supportive fiscal policies in key countries, and the ongoing global AI boom,” Ashworth said. “However, there remains significant uncertainty across a wide range of risks, particularly on the geopolitical front, with risks more heavily skewed to the downside.”

According to Ashworth, the survey suggests a moderation in global growth rather than a sharp downturn, but subdued confidence and corporate caution could amplify the impact of external shocks.

“Were another major global shock to occur over the coming quarters, it could push firms into retrenchment, increasing the risk of a more pronounced slowdown in global growth,” he added.

While confidence improved in Asia-Pacific, sentiment weakened in North America. Alain Mulder, senior director for Europe operations and Global Special Projects at IMA, said accountants in the region remained notably pessimistic.

“Higher import tariffs, policy uncertainty and elevated interest rates continue to weigh on sentiment,” said Mulder.

|

He added that employment and capital expenditure indicators pointed to pronounced caution among businesses in advanced economies. In North America, the Employment Index fell to a record low in the fourth quarter, even below levels seen during the pandemic, while the Capital Expenditure Index dropped to its second-lowest reading on record.

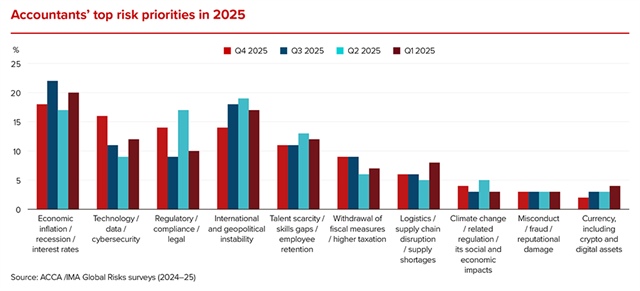

Beyond macroeconomic concerns, respondents identified economic pressure, cyber disruption and geopolitical uncertainty as their top risk priorities, highlighting an increasingly complex and interconnected risk landscape. Despite heightened awareness, preparedness for non-financial shocks such as cyber threats, fraud and misconduct remained only moderate, pointing to a gap between risk recognition and organisational readiness.

|

- 20:21 22/01/2026