Corporate bond market impacted with restructure

Corporate bond market impacted with restructure

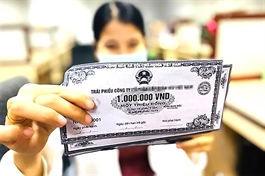

The corporate bond market, as a key channel for medium- and long-term capital supply to the economy, is expected to rebound strongly following recent restructuring in Vietnam.

According to a weekly report published by the Vietnam Bond Market Association on March 5, no corporate bond issuances were recorded last month as of the disclosure date on February 28, while January saw four public corporate bond issuances, with a total value of approximately $222.16 million.

In February, enterprises repurchased $103.68 million worth of bonds. Cumulatively, in the first two months, the total value of early bond buybacks reached $639 million, marking a 13.1 per cent increase compared to 2024.

“In the remaining 10 months of the year, the total value of bonds maturing will amount to $7.69 billion. Of this, 54.6 per cent of the maturing bond value, or $4.2 billion, belongs to the real estate sector, followed by the banking sector with $1.65 billion, representing 21.4 per cent,” stated the report.

Despite the absence of corporate bond issuances in February, Nguyen Quang Thuan, CEO of FiinRatings, forecasted double-digit growth in the market this year.

“We expect strong growth momentum in 2025 from banks, non-bank financial institutions, and major corporate sectors, including residential properties, power, and infrastructure,” he said. “Banks are looking to issue tier-2 bonds in the current relatively low-interest-rate environment to meet high credit growth needs while also improving prudential ratios, such as capital adequacy and restrictions on short-term funding for medium- and long-term credit.”

Thuan also projected a resurgence in bond issuances by financially strong residential developers and the revival of the country’s Power Development Plan VIII implementation.

“Improving transparency through new regulations will impact both privately placed and publicly offered bonds, with revised conditions for qualified issuers and enhanced information disclosure, including mandatory rating enforcement under certain conditions,” added Thuan.

To achieve the Vietnamese government’s goal of expanding the corporate bond market to 20 per cent of GDP, Nguyen Thi Trieu, CEO of Blue Bridge Investment Partners, emphasised the need to diversify issuance structures, increase the proportion of credit-rated bonds, and boost the development of the secondary corporate bond market.

“To lessen reliance on banks and real estate, which make up 90 per cent of corporate bond issuances, fostering sustainable sectors like green transport, renewable energy, circular agriculture, and clean tech is crucial. Incentives on interest rates and issuance costs should support green and sustainable bonds, backed by clear regulations on green frameworks and the soon-to-be-enacted green taxonomy,” Trieu stated.

Trieu stressed that only 0.3 per cent of corporate bonds in Vietnam are currently rated, significantly lower than Indonesia with 82 per cent and Thailand with 65 per cent.

“The share of credit-rated bonds in Vietnam is set to increase under the amended Securities Law, requiring ratings for privately placed bonds sold to professional investors. This will diversify the investor base, drawing foreign funds and insurers, and boosting issuance volumes,” Trieu noted. “Publicly offered corporate bonds are also awaiting amendments to Decree 155 regarding issuance conditions and credit rating requirements, aiming to standardise regulations and reduce the processing time for approval from the State Securities Commission.”

Le Hong Khang, analytical director at FiinRatings, observed that the Vietnamese economy would benefit from a more balanced capital structure, as it currently relies heavily on short-term debt.

“This reliance reduces corporate flexibility in planning long-term business strategies. The corporate bond market has the potential to play a more significant role in supporting the economy’s capital needs,” Khang said.

Citing changes passed by the National Assembly in November 2024 to amend certain provisions of the Securities Law related to the corporate bond market, Khang noted that such revisions aim to enhance transparency and efficiency in bond issuance and offering activities.

“As Vietnam continues advancing its development agenda, the corporate bond market will become increasingly vital in supporting capital demands. While the government is actively pushing reforms, infrastructure improvements, and capital market enhancements, a greater focus must be placed on expanding the corporate bond market and improving accessibility for institutional investors,” he said.

In its 2025 bond market outlook report released last week, Vietcombank Securities (VCBS) analysts noted that in the context of persistently low deposit interest rates, investors are shifting capital towards higher-yielding investment channels. This trend is expected to support the corporate bond market, provided that market stability is maintained, thereby bolstering investor confidence and interest.

They also projected a more optimistic outlook for the corporate bond market this year, with bank-issued bonds continuing to lead, while real estate firms gradually regain investor confidence.

“Liquidity in the secondary private corporate bond market remains high, contributing to improved cash flow for bond issuers. Additionally, the development of credit rating products enhances investor awareness of risks associated with corporate bonds, ensuring the market’s sustainable growth,” the VCBS report said.

On the demand side, institutional investors will continue to dominate the corporate bond market, particularly in private placements. Meanwhile, retail investors with smaller capital will likely favour publicly offered bonds issued by credit-rated companies, the report added.

Nguyen Ly Thanh Luong, lead analyst at VIS Rating, forecasted a clear recovery in the corporate bond market this year, with new issuance volumes expected to surpass 2024 levels, marking stable growth of approximately 23 per cent.

“Risks related to delayed principal and interest payments are expected to remain low. The sharp decline in new payment delays last year has set a positive precedent, as most cases involved enterprises that previously faced difficulties and are now undergoing restructuring,” Luong said. “The real estate sector, which accounts for a significant share of delayed bonds, is benefiting from regulatory adjustments such as new planning approvals, improving cash flow and debt resolution capabilities.”

- 16:00 11/03/2025