Government bond auctions raise over VNĐ29 trillion in February

Government bond auctions raise over VNĐ29 trillion in February

In the first two months of the year, government bond issuances through HNX auctions reached VNĐ45.11 trillion, fulfilling 41 per cent of the first-quarter target and 9 per cent of the annual plan for 2025.

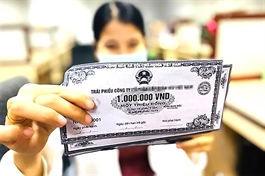

A banking staff counts cash at a Vietinbank branch in Hà Nội. — Photo tapchicongthuong.vn |

The Hanoi Stock Exchange (HNX) reported that in February 2025, a total of 16 Government bond auctions were conducted, successfully raising nearly VNĐ29.13 trillion (US$1.2 billion) for the State Treasury.

In the first two months of the year, Government bond issuances through HNX auctions reached VNĐ45.11 trillion, fulfilling 41 per cent of the first-quarter target and 9 per cent of the annual plan for 2025.

In February, bonds were successfully issued in three maturities: 10 years, 15 years and 30 years. The 10-year bonds accounted for the largest share, comprising 96 per cent of the total issuance, equivalent to VNĐ27.96 trillion.

The interest rates for government bonds at the end of February stood at 2.97 per cent for the 10-year term, 3 per cent for the 15-year term and 3.28 per cent for the 30-year term, reflecting an increase of 0.03-0.14 percentage points compared to the previous month.

On the secondary market, as of February 28, the total listed value of government bonds reached VNĐ2.25 quadrillion. The average daily trading volume in February was VNĐ13.34 trillion, marking a 28.14 per cent increase from the previous month. Outright transactions accounted for 66.76 per cent of total trading value, while repurchase agreements (Repos) made up 33.23 per cent.

Regarding investor composition, commercial banks remained the dominant participants, representing 50.92 per cent of outright transactions and 93.39 per cent of Repos. Securities companies accounted for 49.08 per cent of outright trades and 1.34 per cent of Repos. Foreign investors contributed 1.71 per cent of total market transactions, with net purchases of VNĐ583 billion.

In terms of yields, the most significant increases were observed in 7-year and 10-year Government bonds, which reached approximately 2.66 per cent and 3.06 per cent, respectively. The sharpest declines were recorded in the 10-15 year and 6-month maturities, now standing at around 3.02 per cent and 0.95 per cent.

Trading activities were most concentrated on medium- and long-term bonds, particularly in the 10-year, 10-15 year and 25-30 year maturities, which accounted for 21.7 per cent, 15.65 per cent and 9.74 per cent of total market transactions, respectively.

- 11:26 06/03/2025