Corporate bonds in the manufacturing sector absent from the 2024 growth wave

Corporate bonds in the manufacturing sector absent from the 2024 growth wave

The corporate bond market successfully raised nearly VNĐ500 trillion (US$20.6 billion) for the economy in 2024, yet the bulk of this capital came from banks. Non-bank enterprises, including manufacturing, services and real estate sectors, continued to face limited access to this funding channel.

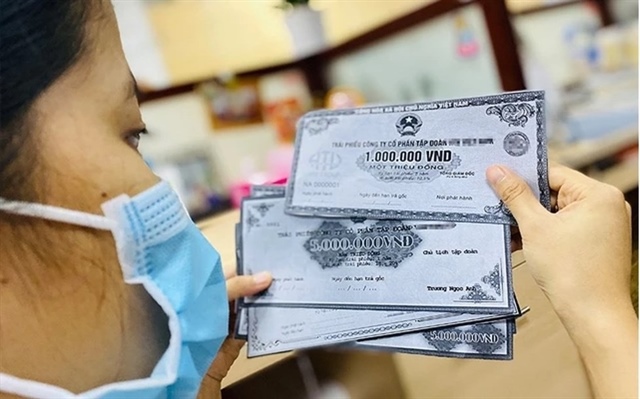

The corporate bond market grew in 2024, but manufacturing corporate bonds remained absent. — Photo bnews.vn |

The corporate bond market grew in 2024, but manufacturing corporate bonds remained absent. — Photo bnews.vn

HÀ NỘI — Despite a strong surge in corporate bond (CB) issuance in 2024, concerns remain as the market's structure has heavily leaned towards the banking sector, which accounted for 68.3 per cent of total issuances. Meanwhile, bonds from manufacturing enterprises were nearly absent, dropping from 8 per cent in 2023.

The corporate bond market successfully raised nearly VNĐ450 trillion (US$17.7 billion) for the economy in 2024, yet the bulk of this capital came from banks. Non-bank enterprises, including manufacturing, services and real estate sectors, continued to face limited access to this funding channel.

The total value of corporate bonds issued in 2024 reached VNĐ445 trillion, marking a 30 per cent increase compared to 2023. This represents the strongest annual growth since the peak years of 2020–2021, before the fallout from the Tân Hoàng Minh scandal disrupted the market.

CEO of FIDT Investment and Asset Management Ngô Thành Huấn told baodautu.vn that weak bond issuance in the manufacturing and services sectors is due to the economic downturn and declining domestic demand.

"We underestimated the extent of the economic recession and its impact on market demand. With reduced demand, businesses have less need for capital, which explains why the corporate bond market in 2024 is dominated by banks, while non-bank bond issuances are recovering slowly," Huấn said.

CEO of FiinRatings Nguyễn Quang Thuân expects non-financial corporate bonds to become more active in 2025, driven by legal improvements in real estate, energy and infrastructure sectors.

Thuân emphasised key areas for capital demand in 2025, including industrial real estate driven by increasing FDI, residential real estate supported by regulatory easing and renewable energy boosted by the swift rollout of Power Development Plan VIII to mitigate potential power shortages by 2026. Furthermore, consumer credit demand is anticipated to rise alongside economic growth.

Lê Xuân Nghĩa, an economic expert, noted that the corporate bond market reflects the structural issues within Việt Nam's economy. Despite high GDP growth, Việt Nam's exports remain heavily reliant on foreign direct investment (FDI) enterprises, with domestic manufacturing contributing only a small share, primarily in agriculture, forestry and fisheries.

"The domestic manufacturing sector is weak and the economy is heavily dependent on FDI enterprises, real estate and banking sectors. As a result, corporate bond issuances are predominantly from banks and real estate firms, while manufacturing bonds are almost non-existent," Nghĩa said.

He added that many manufacturing enterprises face severe capital shortages but are unable to issue bonds due to high interest rates, short maturities and increasingly stringent issuance requirements. Consequently, banks dominate the corporate bond market, increasing the economy's reliance on bank credit.

Green bonds in 2025

According to FiinRatings, there were 18 green bond issuances between 2018 and 2023. In 2024, the market recorded four green bond transactions valued at VNĐ6.87 trillion, meeting international green standards.

Thuân expects the green bond market to grow significantly in 2025, driven by institutional investor demand, corporate commitment and an improving regulatory framework.

"We hope the Government will soon finalise the Green Bond Taxonomy and Green Credit Framework in 2025 to create a solid foundation for sustainable finance in Việt Nam and attract green capital flows into domestic enterprises," Thuân said.

Promoting green bond issuances will enhance the quality of assets in the corporate bond market and attract capital from both domestic and international investors. Under the revised Securities Law, from 2026, individual professional investors will face tighter restrictions when participating in corporate bond investments.

Experts are optimistic that favourable policies in 2025 will attract institutional investors, particularly foreign funds, to compensate for the anticipated reduction in individual investor participation.