Corporate bond issuance drops by 60% in Sept

Corporate bond issuance drops by 60% in Sept

The total value of corporate bond issuances in September dropped significantly, by 60 per cent from August, to the lowest figure recorded since May, a recent report showed.

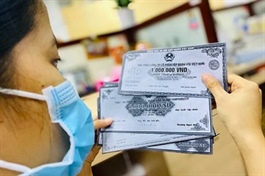

There were 268 private placements totalling VNĐ250.4 trillion and 15 public bond issuances in the first nine months of the year. — VNA/VNS Photo |

There were 24 private placements of corporate bonds totalling over VNĐ22.3 trillion (US$898.6 million) and one public issuance amounting to nearly VNĐ1.5 trillion in September, according to data compiled by the Vietnam Bond Market Association (VBMA) from the Hà Nội Stock Exchange (HNX) and the Securities Commission of Việt Nam (SSC).

Consequently, the total value of corporate bond issuances in September was only 40 per cent of the previous month (August saw issuances surpassing VNĐ60 trillion), marking a five-month low.

For the first nine months of the year, there were 268 private placements totalling VNĐ250.4 trillion and 15 public bond issuances amounting to more than VNĐ27 trillion.

Notably, commercial banks represented 72 per cent of the total bond issuance value, while real estate enterprises accounted for 18.54 per cent.

In September, businesses repurchased nearly VNĐ11.75 trillion in maturing bonds, up two per cent from 2023.

For the rest of 2024, an estimated VNĐ79.86 trillion in bonds are expected to mature, with real estate bonds accounting for VNĐ35.13 trillion (44 per cent). Additionally, 26 new instances of defaulted interest bonds worth VNĐ239.4 billion and two defaulted principal bonds worth VNĐ550.4 billion were reported.

On the secondary market, corporate bond transactions totalled nearly VNĐ87.8 trillion in September, with an average of over VNĐ4.6 trillion per session, a 40.2 per cent increase from August.

Last month, the State Treasury held 18 government bond auctions totalling VNĐ50.15 trillion, with a 66.5 per cent bidding success rate.

The Treasury auctioned bonds with maturities ranging from 5 to 30 years. Notably, 10-year and 15-year terms received the majority of bids, totalling VNĐ22.15 trillion (66 per cent) and VNĐ8.55 trillion (26 per cent), respectively.

Government bond issuances through auctions in the first nine months reached VNĐ271.6 trillion, 67.9 per cent of the annual plan. The average term issued in September was 12.09 years, with an average winning bid interest rate of 2.73 per cent per annum.

The Ministry of Finance will not provide guarantees for bonds issued by the Việt Nam Social Policy Bank and Việt Nam Development Bank in 2024, as per documents 6139/BTC-QLN and 6140/BTC-QLN.