Bitexco Group to transfer stake at Saigon Glory for bond repayment

Bitexco Group to transfer stake at Saigon Glory for bond repayment

Bitexco Group has reached an agreement to transfer its 100 per cent stake in Saigon Glory, the developer of the luxury One Central HCM twin towers in central HCM City, to Eastern Hanoi Real Estate Company Limited.

After multiple ownership changes, including by Viva Land, a subsidiary of Vạn Thịnh Phát Group, the One Central HCM twin towers project has remained inactive since the end of 2022. — VNS Photo Bồ Xuân Hiệp |

The decision aims to address the bond debt obligations of Saigon Glory amid increasing pressure from bondholders.

According to Tân Việt Securities Joint Stock Company (TVSI), the transfer will not affect the rights of the bondholders.

Bitexco Group has committed to fulfilling interest payments on ten bond lots from September 1, 2024, until June 18, 2025, according to TVSI.

Meanwhile, Eastern Hanoi Real Estate Company Limited will take over the responsibility for principal and interest payments on these bonds until maturity, it added.

Following the transfer, 100 per cent of Saigon Glory’s capital will remain mortgaged to secure bond obligations at Techcombank.

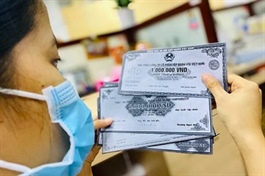

In 2020, Bitexco used its stake in Saigon Glory as collateral for VNĐ10 trillion (US$425 million) in bonds, set to mature between June 2025 and November 2026.

Saigon Glory has faced difficulties in making bond interest repayments since late 2022, following the arrest of Trương Mỹ Lan, chairwoman of Vạn Thịnh Phát Group, currently on death row for financial fraud.

The State Securities Commission (SSC) recently penalised Saigon Glory for failing to disclose mandatory information, further complicating its financial standing.

In a recent communication, Bitexco requested an extension of repayment deadlines to facilitate financial restructuring.

In February, the company negotiated to extend the maturity of the bonds by one to two years at an interest rate of 8 per cent.

Việt Nam is facing significant challenges in its corporate bond market and real estate sector, amid the ongoing national anti-corruption campaign which intensified in 2022.