Becamex repurchases VNĐ400 billion bonds due in 2025

Becamex repurchases VNĐ400 billion bonds due in 2025

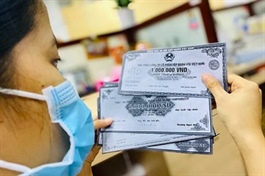

After releasing about VNĐ1.3 trillion (US$52.7 million) worth of bonds within two months, Becamex has now initiated the repurchase of a portion of bonds due in August 2025.

Becamex Bàu Bàng Industrial Park in Bình Dương Province. — Photo becamex.com.vn |

On September 4, the company repurchased VNĐ400 billion of bonds under the code BCMH2025002, trimming its debt from VNĐ1.2 trillion to VNĐ800 billion.

The BCMH2025002 bond, issued on August 31, 2020, matures in five years, with a face value of VNĐ2 trillion.

On August 14, Becamex successfully launched VNĐ300 billion in bonds with the code BCMH2427004, set to mature in three years on August 14, 2027.

On August 8, the property developer introduced VNĐ200 billion worth of bonds under the code BCMH2427002, maturing in three years on August 8, 2027.

Earlier, on June 17, it effectively issued VNĐ800 billion in bonds, identified as BCMH2427001, with a three-year term and a maturity date of June 17, 2027, offering an annual interest rate of 10.5 per cent.

Over a span of just two months, Becamex has raised around VNĐ1.3 trillion through three-year bonds, all set to mature in 2027.

As of June 30, its total short-term and long-term borrowings have surged by 7.9 per cent compared to the beginning of the year, adding nearly VNĐ1.6 trillion to more than VNĐ21.3 trillion, representing 107.3 per cent of the total equity.

For the first half of 2024, Becamex saw a 4.7 per cent increase in revenue to nearly VNĐ2 trillion and a substantial 950.5 per cent rise in profit after tax to VNĐ513.38 billion.

In 2024, the company aims for a total revenue of VNĐ9 trillion, up 2 per cent from the previous year, with an expected profit after tax of VNĐ2.35 trillion, a 3 per cent increase.