Energy company to divest hotel to meet bond repayment obligations

Energy company to divest hotel to meet bond repayment obligations

BB Sunrise Power, a subsidiary of Bitexco Group, has announced its intention to divest a hotel in Lào Cai Province to fulfill its bond repayment obligations.

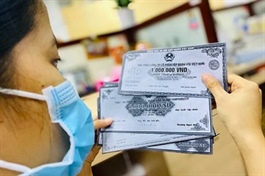

The Victoria Sapa hotel in the well-known tourist destination of Sapa. — Photo courtesy of the hotel management |

The Victoria Sapa Hotel, situated in the well-known tourist destination of Sapa, was previously utilised as collateral for bond issuance and is currently appraised at VNĐ210 billion (US$8.4 million).

After accounting for expenses and taxes totaling VNĐ30 billion, a net amount of VNĐ180 billion will be allocated to repay the principal and interest on the bonds.

Founded in 2019 with a charter capital of VNĐ500 billion, BB Sunrise Power is involved in various sectors of the energy industry, including hydropower, solar, and wind projects across the region.

In a related development, Bitexco Group in September transferred its entire stake in Saigon Glory, the developer of the One Central HCM project, to Eastern Hanoi Real Estate Company based in Hà Nội. The transaction also aimed to address bond repayment obligations.

The decision comes amid increasing pressure from bondholders, as Saigon Glory has encountered difficulties in meeting interest payments since late 2022, following the arrest of Trương Mỹ Lan, the chairwoman of Vạn Thịnh Phát Group.

Bitexco has committed to ensuring interest payments on ten bond lots from September 2024 through June 2025, while Eastern Hanoi will take on the responsibility for both principal and interest payments until maturity.

Việt Nam’s corporate bond market is facing significant challenges due to a sluggish real estate sector, exacerbated by an intensified government anti-corruption campaign initiated in 2022.

According to FiinRatings, bond issuers, particularly within the real estate sector, are expected to encounter substantial repayment pressures in 2024 and 2025, as overdue bonds from 2022-2023 have been extended for up to two years under a government decree issued in 2023.

Meanwhile, VIS Ratings have estimated that VNĐ216 trillion of corporate bonds are set to mature next year, with 9 per cent categorised as being at high risk of default.

Experts have cautioned that extending maturity dates involves risks and requires cooperation from bondholders and creditors.

Negotiations can be complex, needing a thorough assessment of a company’s financial health, they said.

Concerns about how these extensions affect market perception and creditworthiness may hinder future funding, they added.

Companies are advised to use the extension wisely by implementing cost-cutting measures and diversifying revenue while maintaining communication with bondholders.

S&P Global Ratings have reported that the real estate sector has the largest outstanding bond value at nearly VNĐ400 trillion, about 34 per cent of total bonds.

Without improvement, more defaults may occur, it cautioned.