Banks issue bonds to raise long-term capital, adhere to regulations

Banks issue bonds to raise long-term capital, adhere to regulations

Commercial banks are seeking to issue bonds to raise long-term capital while adhering to capital safety regulations set by the central bank.

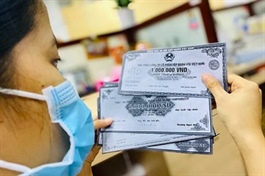

A branch of fully state-owned Agribank in HCM City. Commercial banks are seeking to issue bonds to raise long-term capital while adhering to the capital safety regulations set by the central bank. — VNS Photo Bồ Xuân Hiệp |

Banks issued bonds totaling VNĐ27 trillion (US$1.15 billion) last month, or 87 per cent of total corporate bond issuance in the market and double the amount recorded the same time last year, according to a report by local credit rating agency FiinRatings.

Banks issued bonds worth VNĐ169 trillion as of the end of July with major issuers including MBBank (VNĐ10 trillion), Vietinbank (VNĐ5 trillion), and SHB (VNĐ3 trillion).

“Banks are consistently issuing bonds to bolster their Tier 2 capital in compliance with the regulations set forth by the central bank,” according to another credit rating agency, VIS Rating.

Projected bond issuances for the remaining months of the year include plans from Vietinbank (VNĐ8 trillion), LPBank (VNĐ6 trillion), ACB (VNĐ15 trillion), SHB (VNĐ5 trillion), and BIDV (VNĐ4 trillion), among others.

Last month, fully state-owned Agribank announced plans to issue 10 million bonds to the public, with a total value of VNĐ10 trillion.

The interest rate on these bonds is set to be 2 per cent higher than the average 12-month savings deposit interest rate offered by the four largest state-owned commercial banks (Agribank, Vietinbank, BIDV, and Vietcombank) for the first five years, and 3 per cent higher for the remaining five years.

Based on current interest rates, this rate may exceed 6 per cent annually in the first year.

The bond issuance aims to secure long-term capital to address the economy’s demand for loans.

These bonds may also serve as collateral for bank loans at preferential interest rates.

Stringent regulations

The central bank has mandated a reduction in the maximum ratio of short-term capital allocated for medium- and long-term lending to 30 per cent, down from the previous limit of 34 per cent.

It has also stipulated that loans must not exceed 85 per cent of total mobilised capital.

The stringent regulations on credit safety limits and adequacy for medium- and long-term capital set by the central bank is pushing banks to issue bonds.

Amid slowing deposit growth attributed to low interest rates, banks are increasingly seeking alternative funding sources through the bond market.

VIS Rating has projected a requirement of VNĐ283 trillion of capital-raising bonds over the next three years for banks to maintain internal capital and comply with safety ratios.

The central bank has set a credit growth target of 14-15 per cent for this year. Credit reached nearly VNĐ14.4 quadrillion in the first half, up 6 per cent since the beginning of the year.

Non-performing loans within the banking system rose by VNĐ75.9 trillion in the first five months, according to the latest data from the central bank.

The bad debt ratio of the banking system stood at 4.94 per cent as of the end of May, up from the 4.55 per cent at the end of last year, according to the data.