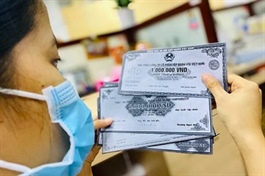

Bond market recovery slowed by weak institutional investor support

Bond market recovery slowed by weak institutional investor support

Despite positive signs of recovery, Vietnam's corporate bond market remains fragile due to the limited presence of institutional investors, highlighting the need for stronger participation to ensure long-term stability.

According to VIS Rating's report in late September, most bonds issued and traded on the secondary market are private placements, typically by newly established companies without core business operations. As a result, there is limited public information available for investors to assess and manage risks effectively.

"Data reveals that nearly half of bond repayment delays between 2022 and 2023 involved newly formed companies with weak financials, yet these firms were still able to issue bonds at attractive interest rates. Many of these bonds are still traded on the secondary market at yields that are not significantly higher than those issued by financially stable companies," said the report.

VIS Rating notes that, compared to more developed corporate bond markets in the region, Vietnam lacks institutional investors with long-term investment strategies and the risk tolerance necessary to navigate short-term market fluctuations.

In the draft of the revised Securities Law, expected to be enacted sometime in the fourth quarter of this year, regulators are aiming to introduce additional safeguards to curb excessive risk-taking. One such measure would limit private bond placements to professional institutional investors. As a result, the increased participation of institutional investors is seen as critical to the sustainable growth of the corporate bond market.

As of the end of June, institutional investors, including insurance companies, pension funds, and investment funds, held just 8 per cent of all corporate bonds in circulation, according to data from the Ministry of Finance and mid-year financial reports. The Vietnam Social Security Fund (VSSF), the country’s largest institutional investor, managed around $48 billion in assets as of December 2023, but has yet to begin investing in corporate bonds.

Unlike retail investors, who often focus on short-term returns, institutional investors typically conduct thorough risk assessments, invest with a long-term view, and are better equipped to manage short-term volatility. The absence of these investors in Vietnam’s corporate bond market has been highlighted by several financial institutions as a key weakness.

In its August report, the World Bank pointed out that the dominance of retail investors in non-government bond markets has led to herd behaviour, heightening volatility and concentrating risks in corporate bonds. This has also impeded the equity market's capacity to support corporate capital raising.

According to the report, a core issue is Vietnam's underdeveloped institutional investor base, including the limited role of social insurance funds, which have significant potential to drive capital market growth.

With assets equivalent to 10 per cent of GDP, VSSF is Vietnam’s largest institutional investor, surpassing the combined assets of all other domestic institutional investors. However, due to legal restrictions, VSSF’s investments are concentrated primarily in government bonds and bank deposits.

Diversifying VSSF’s investments is seen as essential for accelerating the modernisation of Vietnam’s financial system and bringing greater stability to the market, given its potential as a long-term investor. In addition to VSSF, other institutional investors, such as life insurance companies and private pension funds, should be encouraged to engage in the corporate bond market to foster sustainable development.

The World Bank also recommended reforms to make corporate bonds more attractive to institutional investors, particularly through improved transparency and enhanced investor protections. Such reforms are critical to shifting the market from a retail-dominated landscape to one that is driven by institutional players.

"The criteria for defining professional investors should be refined to ensure they are capable of properly assessing risk, and the procedures for public bond offerings need further improvement. Additionally, credit rating requirements should be expanded, especially for instruments targeted at retail investors," the World Bank report concluded.