Investors remain cautious on bond investments

Investors remain cautious on bond investments

Commercial banks' exclusive involvement in issuing and holding corporate bonds reflects the persisting lack of confidence in the bond market, from both retail and institutional investors.

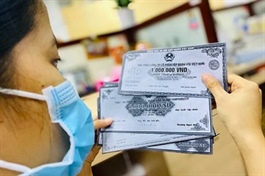

Banks maintain a significant lead in bond issuance value for the first eight months of the year. — VNS Photo |

As of August 30, there were 43 private placements of corporate bonds in August, amounting to nearly VNĐ38 trillion (US$1.55 billion) and two public bond issuances totalling VNĐ11 trillion, data from the Việt Nam Bond Market Association showed.

Year-to-date figures show 227 private placements valued at nearly VNĐ215.6 trillion and 13 public issuances worth over VNĐ22.77 trillion.

Last month, companies repurchased bonds worth more than VNĐ11 trillion before maturity, marking a 45 per cent decrease from the same period in 2023.

In the last months of 2024, it is projected that close to VNĐ106 trillion in bonds will mature, with a significant portion, approximately VNĐ43.35 trillion, being real estate bonds, representing nearly 41 per cent of the total.

Regarding unusual disclosures, August saw ten bond codes with delayed interest payments totalling VNĐ197.5 billion and one bond code with delayed principal repayment of VNĐ998 billion.

In terms of structuring, banks maintain a significant lead in issuance value for the first eight months of the year, holding a share of 72.18 per cent, followed by the real estate sector at 18.54 per cent.

Other sectors like securities, construction and transportation also play a role, while corporate bonds from manufacturing firms are notably scarce in the market.

According to Mirae Asset Vietnam Securities, current trends show that credit institutions are issuing substantial bonds to raise capital to meet the growing credit demand, given the imbalance between deposit and credit growth.

Meanwhile, real estate companies are increasingly issuing corporate bonds, partly for financial restructuring and to support new projects, especially amid relatively low supply sources.

The Ministry of Finance said that while corporate bond issuances have surged, a significant chunk is still held by commercial banks, about 63.2 per cent.

This suggests that retail investors' confidence in the market hasn't fully rebounded, with safe haven assets remaining popular.

Banking investments in corporate bonds remain restricted, reflecting caution from both retail investors and banks.

Notable upcoming issuance plans include Kinh Bắc City Development Holding Corporation, set to issue non-convertible, asset-backed bonds with a two year term and a fixed 10.5 per cent annual interest rate, totalling a maximum of VNĐ1 trillion in the third quarter.

Asia Commercial Joint Stock Bank (ACB) plans to issue 15 batches of non-convertible, unsecured bonds with a maximum value of VNĐ15,000 billion in 2024.

Each bond has a face value of VNĐ100 million with a maximum term of five years and no warrants.