BID121028: Bonds could be delisted

BID121028: Bonds could be delisted

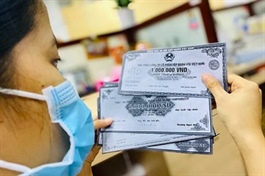

- Bond code: BID121028

- Name of issuer: Joint Stock Commercial Bank for Investment and Development of Vietnam

- Par value: VND100,000/bond

- Number: 9,710,000 bonds

- Maturity date: 29/10/2024

This bond is likely to be delisted according to the notice No.18906/TB-BIDV dated 26/09/2024 of the company. Hanoi Stock Exchange will enforce to delist mandatorily this bond according to regulations.

HNX