Settlement of weak banks remains tough

Settlement of weak banks remains tough

The settlement of weak banks has faced difficulties as the work mainly depends on the voluntary participation of well-performed banks, the State Bank of Vietnam (SBV) said.

Customers make transactions at a GPBank office. Current policies and financial resources to handle weak banks still have many inadequacies. — Photo gpbank.com.vn |

In a report sent to the National Assembly recently, the SBV said the search and negotiation with well-performed banks, which qualify and agree to receive the transfer of weak banks, have taken longer and is difficult due to dependence on the voluntary participation of the well-performed banks. The qualified banks must have good financial strength, governance and experience in restructuring weak banks.

According to the SBV, current policies and financial resources to handle weak banks still have many inadequacies, obstacles and time-consuming procedures.

In addition, the SBV said, the coordination and consultation of ministries and branches in the work is still taking a long time because the handling of weak banks is complicated and unprecedented.

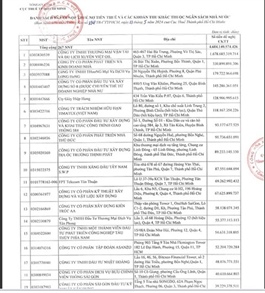

According to a report of the State Audit of Vietnam (SAV), progress in handling weak credit institutions, including OceanBank, GPBank and CBBank, is slow as it has lasted many years (since 2015). By the time of the audit in August last year, the handling of the three banks was only at the stage of the Government's approval of the mandatory transfer policy, and determining the bank value.

DongA Bank must be also transferred to another bank because its equity is negative according to current legal regulations, but the work has been also sluggish.

According to the SAV’s report, the extension of the handling has led to an increase in the expected capital sources that have been used to aid the handling through special loan forms because the weak banks have reported consecutive losses.

The financial situation of the banks was still very difficult. Specifically, bad debts and mortgaged assets remained high; equity was negative; while accumulated losses continued to increase and failed to meet safety regulations in banking activities.

The SAV recommended that the SBV speed up the handling of weak banks, noting that the SBV should coordinate with agencies to propose monitoring and intervention measures in accordance with the law to avoid losing the property of the State and people and ensure the safety and stability of the banking system.

To speed up the settlement of weak banks, the SBV has so far proposed some incentive policies on reserve requirement ratio and credit growth for banks, which receive the compulsory transfer of weak banks. Accordingly, the latter will have their reserve requirement ratio reduced by 50 per cent and credit growth quota higher than others.