Livestream sellers must pay personal income tax: Deputy Minister

Livestream sellers must pay personal income tax: Deputy Minister

E-commerce and livestream sales are activities that have arisen in the development of information technology.

Individuals who generate revenue and income from sales via livestream must pay personal income tax, according to the Ministry of Finance.

In Vietnam, consumers now often purchase online. Photo: Shopee |

Speaking at the regular press conference last week, Deputy Minister of Finance Nguyen Duc Chi said that livestream sales have generated revenue and potentially income that must be subject to tax laws and regulations, as well as the supervision of tax authorities.

He added that those who earn money from e-commerce and online livestream sales will have to pay personal income tax under the law. Business households that engage in e-commerce or online livestreaming and generate income will pay presumptive tax or file regular tax returns.

The Ministry of Finance said the tax authority has come up with many solutions to facilitate tax payments, including requiring owners of e-commerce trading platforms to file tax returns and pay taxes on behalf of individuals doing business on the platform.

This solution will contribute to the reform of administrative procedures, reduce the number of tax returns and the cost of carrying out administrative procedures. "There will be only one reference, which is the e-commerce exchanges, who declare and pay taxes, instead of tens of thousands of individuals," the Ministry said.

According to the Ministry of Finance, e-exchanges are justified to pay the tax on behalf of those who conduct business on their platforms, since they have complete information about buyers, successful sales transactions, income and expenses of companies and individuals.

Finance Minister Ho Duc Phuc said that this year, the tax authority will focus on collecting taxes from domestic e-commerce exchanges and online trading businesses.

At present, the tax industry has first completed data sharing with agencies such as police and banks. This will help tighten e-commerce channel management and control e-commerce payments.

The minister also asked the State Bank to promote cashless payments to monitor e-commerce revenues.

Deputy Minister Chi said that by strengthening tax management of e-commerce activities, including livestream sales, the tax authorities have increased budget revenue.

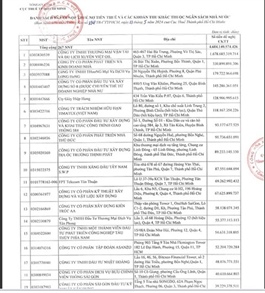

In 2023, about VND97 trillion ($3.8 billion) in tax revenue was collected from organizations and individuals engaged in e-commerce business activities, including livestream selling.

The Deputy Minister of Finance also said that from 2021 to 2023, tax authorities handled 22,159 cases of tax evasion or arrears and collect additional tax revenue of nearly VND3 trillion ($117.5 million).