Bank savings of individual customers recover while institutional savings decline

Bank savings of individual customers recover while institutional savings decline

Deposits of individual customers at banks have increased again since February this year, after declining in January, latest statistics from the State Bank of Vietnam (SBV) showed.

A bank teller counts money at a transaction office in Hà Nội. The average deposit interest rate by the end of Q1 2024 was 3.02 per cent per year, down 0.5 per cent compared to the end of 2023. — Photo cafef.vn |

Deposits by the end of February increased by 1.6 per cent compared to the beginning of this year to reach nearly VNĐ6.64 quadrillion.

While savings of individual customers increased, savings of institutions and corporate customers at banks at the end of February this year decreased by 4.66 per cent, compared to the beginning of the year, to VNĐ6.52 quadrillion.

Due to that decline, the total deposits of the entire banking system decreased slightly, from more than VNĐ13.17 quadrillion at the end of January to VNĐ13.16 quadrillion by the end of February 2024.

Previously, total deposits in the banking system at the end of January this year declined nearly VNĐ200 trillion, compared to the end of 2023 to more than VNĐ13.17 quadrillion.

Deposits of individual customers have returned to the banking system in spite of low interest rates, although banks have begun to adjust the rates up.

According to the SBV, as of March 31 this year, the average deposit interest rate was 3.02 per cent per year, down 0.5 per cent compared to the end of 2023.

Data from Q1 2024 financial statements of 27 commercial banks also showed total deposits of the entire banking industry only increased slightly by 0.7 per cent compared to the end of 2023, in the context that deposit interest rates continuously decreased in the first months of the year.

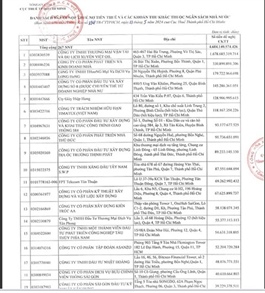

The top three companies which attracted the highest deposits in Q1 2024 were still in the group of State-owned banks with a total savings of more than VNĐ4.51 quadrillion, an increase of VNĐ544.62 trillion compared to the end of 2023 and accounting for nearly 46 per cent of the total deposits of the entire banking system.

BIDV continued to lead with total deposits of more than VNĐ1.7 quadrillion, an increase of 1.8 per cent compared to the end of 2023. VietinBank followed with more than VNĐ1.4 quadrillion, up 1.2 per cent. Vietcombank ranked third with total deposits of VNĐ1.3 quadrillion, down 3.4 per cent.

In the group of private banks, Military Bank led with nearly VNĐ558.83 trillion in deposits in Q1 2024, down 1.5 per cent and ranked fourth in the entire banking industry. Sacombank followed with a deposit of VNĐ533.36 trillion, an increase of 4.4 per cent.

A number of private banks also recorded an increase in deposits in Q1 2024, such as ACB with total deposits increasing by 2.1 per cent to VNĐ492.8 trillion; Techcombank with VNĐ458.04 trillion, up 0.8 per cent; VPBank with VNĐ455.82 trillion, up 3 per cent; and HDBank with VNĐ378.79 trillion, up 2.2 per cent.