Agribank ramps up efforts to spur business development

Agribank ramps up efforts to spur business development

State lender Agribank is exhibiting flexibility through a raft of preferential credit programmes, which are tailored to diverse customer groups and supporting business development.

Agribank has come up with a concessionary credit programme with a scale surpassing $833 million to support import-export businesses for the rest of 2024.

The credit package, lasting from April until the end of the year, offers interest rates of up to 2.4 per cent lower than the normal lending rate floor, plus a slew of other incentives on deposit rates, service fees, and foreign exchange rates. The credit package is applicable to short-term disbursements in VND, and encompassing both credit and non-credit incentives.

Both retail and corporate customers operating in import-export business and seeking short-term loans are eligible for the benefits under the credit package.

In parallel to credit incentives, participants in the scheme are also given the incentives related to deposit interest rates, service fees, and foreign exchange rates. Agribank is also reducing fees for international payment, trade finance transactions and foreign exchange rates until July 2025

Particularly, participants are entitled for fee exemption in regards to import letter of credit payment, import collection payment, and foreign currency transfer for up to three months. The interest rate of demand deposits applicable to import-export businesses under the scheme are also up to 0.3 per cent higher than the current rate.

In the first quarter of this year, Vietnam’s import-export value eyed a double-digit growth surpassing 15.5 per cent on-year. Agribank expects the concessionary credit programme could contribute to upholding economic rebound and development.

From the outset of this year, Agribank has dedicated more than $3.95 billion of credit packages with preferential interest rates to support businesses from across the board.

From March 25, the bank dedicated more than $415 million in a preferential credit package to provide short-term loans to individual customers with the interest rates up to 2.5 per cent annually, lower than the normal lending rate floor of 4 per cent.

The programme is applicable to individual customers who want to take on loans for house repair and purchase; purchases of other essential utensils such as washing machines, TV sets, refrigerators, and air-conditioners; and purchases of motorbikes and cars, aligning with bank regulations.

From March 20, the bank dedicated $2.08 billion to deploy a short-term concessionary credit scheme catered to individual customers serving their production and business requirements.

The lending rates under the programme are maximally 2 per cent per year lower than the normal lending rate floor corresponding to each term of loans serving production and business activities, started from 3 per cent.

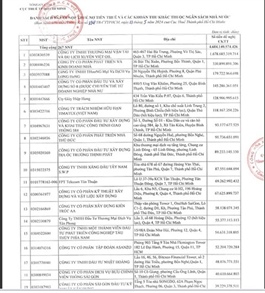

For February to the end of 2024, Agribank has set aside $833 million in preferential credit package to support business groups and corporations belonging to the Commission for Management of State Capital.

Under the scheme, business groups, corporations, and their member units are eligible to borrow short-term loans with very favourable lending rates to deploy production and business plans, conduct projects, engage in infrastructure construction, and trade.

In a bid to bolster contributions to national economic development, Agribank has also signed cooperative agreements with diverse business groups and corporations. The preferential credit scheme is a step in realising the commitment, harmonising Agribank’s interests with the macro interests of Vietnam’s economy.

Support to small- and medium-sized enterprises (SMEs) is also significant. The bank dedicated a short-term preferential credit package valued at $416 million to support SMEs in pushing up production and business activities.

The priority has been given to businesses operating in agro-forestry-fisheries production, processing and trading; salt production; high-tech and organic agriculture; grade 1 agents and suppliers of foreign-invested businesses, or manufacturers in the top 50 largest enterprises in Vietnam who are contributing to promoting green credit and sustainable development according to Agribank’s commitment to environmental, social, and governance criteria.

Agribank has set aside $83 million this year to expedite a preferential credit programme for individual customers investing in the production and trading of One Commune, One Product (OCOP) items with a maximum interest rate 2 per cent lower than the normal level.

The initiative applies to individual customers who borrow to invest in the production and trading of OCOP items, including food and beverage items, medicinal products, and handicrafts.