Vietnam collects US$2 billion in taxes from e-commerce platforms

Vietnam collects US$2 billion in taxes from e-commerce platforms

The finance ministry now manages 144 million e-commerce accounts, including 10 million for organizations and 134 million for individuals

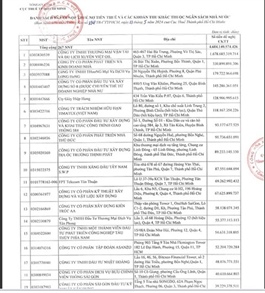

During the first five months of the year, the tax authority collected VND50 trillion (US$2 billion) from e-commerce. In 2023 and 2022, tax revenue from online trade was VND97 trillion (US$3.8 billion) and VND83 trillion ($3.26 trillion), respectively.

Minister of Finance Ho Duc Phoc at the session. Photo: quochoi.vn |

Minister of Finance (MoF) Ho Duc Phoc revealed these figures during the interpellation session at the National Assembly on June 4.

Phoc said the MoF database has been shared with the Ministry of Public Security's residential database and the Ministry of Industry and Trade. They reviewed 929 e-commerce platforms and cross-checked 361 of them to enhance coordination in tax management.

In collaboration with the State Bank of Vietnam, the finance ministry manages 144 million e-commerce accounts, including 10 million for organizations and 134 million for individuals. Phoc noted that 96 foreign service providers, such as Facebook, Google, and TikTok, have registered and paid about VND15.6 trillion ($653 million) in taxes through the MoF’s electronic portal for e-commerce.

"Shortly, we will intensify the synchronized implementation of taxation on e-commerce platforms and electronic transactions," Phoc said.

Amid potential tax losses from import-export activities, Phoc stated that customs authorities have been directed to implement smart customs and, as a member of the World Customs Organization, are actively managing customs matters 24/7 and promoting 100% electronic payments. "We will train officers in information technology to manage electronically," Phoc continued.

Online shopping has become a trend in Vietnam. Photo: Pham Hung/The Hanoi Times |

He added that the MoF is implementing full electronic payments and electronic tax payments to combat smuggling and ensure professional customs clearance. Furthermore, the Ministry will continue to promote the application of information technology in customs to create the best conditions for businesses.

Looking ahead, the MoF will instruct provinces and cities, especially Hanoi and Ho Chi Minh City, to collect taxes from e-commerce trading platforms.

About e-commerce, Minister of Industry and Trade (MoIT) Nguyen Hong Dien said that Vietnam has addressed the challenges of preventing tax revenue loss, resulting in tax payments in 2023 increasing by over 16% compared to 2022.

The MoIT is actively coordinating with the tax sector and the MoF to share data from over 900 websites and nearly 300 e-commerce trading applications to enhance tax management, he noted.

In the future, the MoIT will continue to improve the shared database on e-commerce to interconnect with relevant ministries for better tax and customs management. They aim to complete the system connection between the relevant agencies of the MoIT and the General Department of Taxation by June 2024.

Additionally, the MoIT will strengthen coordination with the Ministry of Public Security to apply electronic identification for sellers on trading platforms to improve tax management efficiency. They will actively inspect and handle violations by businesses, business households, and individuals operating on e-commerce platforms without proper tax returns, emphasized Dien.