Việt Nam's State budget collection up nearly 15 per cent in five months

Việt Nam's State budget collection up nearly 15 per cent in five months

The total state budget collection in the first five months of this year was estimated to reach VNĐ898.4 trillion (US$35.2 billion), equivalent to 52.8 per cent of the yearly estimate, representing a year-on-year rise of almost 15 per cent, according to the Ministry of Finance (MoF).

Domestic revenue was estimated at VNĐ757.5 trillion, equivalent to 52.4 per cent of the estimate and up 16.8 per cent year-on-year. —VNA/VNS Photo |

Of the sum, collection from crude oil was about VNĐ24.7 trillion, equal to 53.6 per cent of the estimate and equal to the figure in the same period last year, while domestic revenue was estimated at VNĐ757.5 trillion, equivalent to 52.4 per cent of the estimate and up 16.8 per cent year-on-year, the ministry reported.

Particularly, revenues from housing and land taxes and fees were estimated at VNĐ90.6 trillion, equivalent to 35.2 per cent of the estimate, up 78.2 per cent over the same period last year. It is attributable to the fact that localities have well organised land auctions and allocated land to projects since the end of last year, generating land use fee payments early this year.

According to the MoF, a surge in domestic revenues reflected an economic recovery. The implementation of policies on the exemption and reduction of taxes, fees and charges have left positive impacts on the performance of businesses and state budget collection as revenues from the business sector were estimated to reach 54.1 per cent of the estimate, a year-on-year increase of 12.7 per cent.

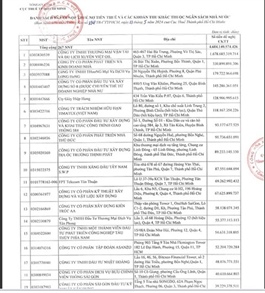

Minister of Finance Hồ Đức Phớc said that in the coming time, the finance sector will continue to roll out measures to collect enough state budget revenue for the whole year. Accordingly, state budget revenue management agencies will continue to strengthen revenue management, inspection and sources, prevent revenue loss, especially relating to real estate business activities, financial service activities, banking, restaurants, hotels, e-commerce, and trade on cross-border digital platforms.

At the same time, the tax sector will inspect and strictly control value-added tax refunds, ensuring compliance with the provisions of laws, focusing on promoting digital transformation, modernising tax collection, and expanding the implementation of e-invoices, the minister added.