State-owned stocks rally as reform expectations lift market sentiment

State-owned stocks rally as reform expectations lift market sentiment

Vietnam’s stock market is witnessing a sharp rally in state-owned enterprise shares, as investors anticipate a new reform-driven cycle following Resolution 79 and a shift in capital allocation dynamics.

The strong acceleration of state-owned enterprise (SOE) stocks in the early days of 2026 suggests that the market is rapidly pricing in expectations of a more substantive transformation cycle.

After years of subdued performance, SOEs have resumed the stock market’s burgeoning attention, buoyed by the recent issuance of Resolution No.79-NQ/TW on the development of the state-owned economy, which not only reaffirms its leading role but also introduces a new institutional framework to unlock resources, reposition operational efficiency and trigger a shift in capital flows.

The banking sector, which holds the largest weight in the stock market, saw clear divergence in 2025 between private joint-stock banks and state-owned commercial banks.

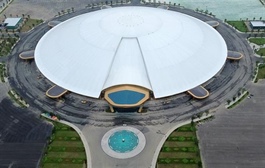

Efficient management of land resources, particularly rubber companies, serves as a key driver for SOEs |

While state-owned bank stocks underperformed the broader market, private banks involved in mandatory transfers of weak lenders posted stronger gains thanks to credit growth exceeding the industry average.

However, the tide has turned since the start of the year. Following the issuance and effect of Resolution 79 on January 6, shares of major state-owned banks such as Vietcombank, BIDV, and VietinBank surged sharply, each reaching new all-time highs.

In BIDV’s trading history since its 2014 listing, investors have never witnessed a rally of such magnitude. From January 6 to January 14, the stock rose for seven consecutive sessions, gaining 43 per cent and repeatedly breaking its own records, with liquidity surging as several sessions recorded trading value exceeding VND1 trillion ($40 million).

Vietcombank also posted a seven-session winning streak, including two sessions with trading value above $80 million each. Rising more than 30 per cent over the same period, the bank climbed to peak territory, approaching $3.2 per share.

Although VietinBank did not sustain as long a rally as BIDV or Vietcombank, it still stood out, gaining over 11 per cent in the first half of January 2026, with its share price at times exceeding $1.6, the highest level in its listing history.

Alongside state-owned banks, many other SOEs also recorded sharp gains. Petrovietnam Gas Corporation (PV GAS) had already signalled an uptrend in the final sessions of 2025, which continued into early 2026.

Throughout 2025, PV GAS largely moved sideways around $2.4-$2.6 per share, but from December 24, the stock found new momentum.

Resolution 79 has been widely seen as a powerful catalyst, pushing PV GAS above the $4 mark, double its level at the end of 2025.

Similarly, strong gains were recorded among other major SOE representatives.

In the first half of January 2026, Vietnam Rubber Group rose 42 per cent, Becamex Investment and Industrial Development Group gained 25 per cent, while Viettel Global Investment Corporation surged as much as 77 per cent.

When outlining market prospects for 2026, many experts have placed SOEs at the heart of their scenarios. Commenting on Resolution 79, analysts from MB Securities (MBS) noted that once resources are effectively unlocked, state-owned enterprises are likely to accelerate.

Drawing parallels with the stimulus from Resolution No.68-NQ/TW on private sector development, MBS expects listed SOEs to become a new focal point in 2026, particularly driven by notable divestment deals in the 2026-2027 period.

Providing more in-depth analysis of the resolution’s impact on the stock market, Nguyen The Minh, head of Research and Development at Yuanta Vietnam Securities, said Resolution 79 influences the market through several key mechanisms.

“For the first time, Resolution 79 allows all proceeds from equitisation and divestment to be used to increase charter capital at state-owned enterprises instead of being remitted to the state budget. This directly addresses the core capital shortage faced by state-owned banks such as BIDV and VietinBank,” Minh said.

In addition, the requirement that the state holds no more than 50 per cent of charter capital in non-strategic commercial enterprises is expected to trigger a new wave of divestments in 2026-2027 period.

Next is the mechanism for unlocking land resources. Clear direction on the efficient management of land resources serves as a key driver for state-owned enterprises – particularly rubber companies – to convert agricultural land into industrial zones, unlocking the potential for a sharp surge in net asset growth.

According to Yuanta Vietnam expert, before 2025, state capital management primarily focused on capital preservation and loss prevention.

“Resolution 79 has fundamentally reshaped this approach by defining the state-owned economy as a material instrument to orient, lead and regulate the broader economy, while its innovative financial mechanisms remove long-standing structural impediments,” Minh said.

- 23:40 23/01/2026