Stock market cap more than doubles after five years: minister

Stock market cap more than doubles after five years: minister

The number of investor accounts surpassed 11 million, exceeding the government's target of 9 million accounts by 2025 and meeting the 2030 target ahead of schedule under the national stock market development strategy.

An investor talks over the phone at a trading office of a securities firm. — Photo bnews.vn |

Việt Nam’s stock market capitalisation has surged over the past five years, rising about 2.3 times compared with early 2020, after the market was officially upgraded in 2025, Finance Minister Nguyễn Văn Thắng said on January 21.

Thắng made the remarks while presenting a policy paper on behalf of the Party Committee of the Ministry of Finance at the 14th National Party Congress, which focused on institutional reforms to mobilise and use financial resources for development.

He reported that the Ministry of Finance has recently submitted Resolution No.68-NQ/TW on private sector development and Resolution No.79-NQ/TW on the growth of state-owned enterprises to the Politburo.

In addition, the ministry has proposed and issued 929 legal documents, including 65 laws and National Assembly resolutions, to remove bottlenecks, meet new development demands and enhance the economy’s competitiveness.

According to Thắng, improvements in institutional frameworks have played a central role in delivering strong economic and fiscal outcomes.

“The stock market was upgraded by the end of last year, with equity market capitalisation increasing approximately 2.3 times compared with the beginning of 2020,” he said.

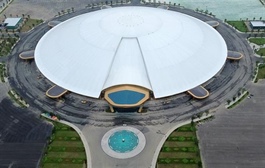

Alongside the market upgrade, Việt Nam has established and put into operation an international financial centre and new-generation free trade zones as part of broader reforms to financial infrastructure, Thắng noted.

In 2025, Việt Nam’s stock market continued to expand in both scale and liquidity. The benchmark VN-Index rose by about 38 per cent year on year, while average daily trading value reached nearly VNĐ29.5 trillion (US$1.1 billion) per session, according to the State Securities Commission.

The number of investor accounts surpassed 11 million, exceeding the Government’s target of 9 million by 2025 and reaching the 2030 target ahead of schedule under the national stock market development strategy.

Beyond financial markets, the minister highlighted progress in business formation and public finance.

Registered corporate capital increased by 37.6 per cent compared with 2020, while state budget revenue over the five-year period reached nearly VNĐ9.9 quadrillion, exceeding targets and standing 1.4 times higher than the previous term.

To support post-pandemic recovery, authorities implemented tax and fee relief measures totalling about VNĐ1.1 quadrillion, benefiting businesses and households affected by COVID-19.

Meanwhile, ministries and local governments increased revenues and cut expenditures by VNĐ1.85 quadrillion, reallocating funds to development investment and social security.

Total public investment during the period amounted to about VNĐ3.4 quadrillion, up nearly 55 per cent from the previous term.

The efficiency of public spending also improved, with the number of projects funded by the central government budget falling sharply from 11,000 to 4,600, according to the minister’s presentation.

The 2026–30 period is critical for Việt Nam’s ambition to become a high-income nation by 2045, with targets including average GDP growth of 10 per cent a year and per capita GDP of $8,500 by 2030. Total social investment is expected to average about 40 per cent of GDP, with budget revenue at 18 per cent and a deficit of 5 per cent.

To meet these goals, strengthening the economic institutional framework is a priority.

Thắng said the finance sector will innovate its policy approaches and complete the drafting of regulatory documents for new laws and resolutions by the end of the first quarter.

The Ministry of Finance will guide the effective implementation of Politburo resolutions, maintaining the leading role of the state-owned economy while promoting the private sector as a key growth driver. Supportive policies will be rolled out to develop cooperative markets and attract foreign investment.

Việt Nam aims to have at least 2 million active private enterprises by 2030 and 50 state-owned companies among the top 500 in Southeast Asia. Public investment will be restructured, with centrally funded projects capped at 3,000.

The financial market will continue to be developed to attract international investment, with an emphasis on building a supportive legal framework for new economic models and financial products. Ongoing policy reviews will seek to remove bottlenecks and foster a transparent business environment, ultimately creating strong growth centres and competitive economic zones. Improved communication will help build consensus among the public and business community.

- 20:23 22/01/2026