Credit management must ensure high GDP growth, macroeconomic stability

Credit management must ensure high GDP growth, macroeconomic stability

Credit management should be cautious and effective to enable linking high economic growth with macroeconomic stability and financial system reforms.

A view of the forum. —Photo baocongthuong.vn |

Credit management should be cautious and effective to enable linking high economic growth with macroeconomic stability and financial system reforms, experts told a forum on Wednesday.

Participants in the forum, which was held in Hà Nội by the Institute for Brand and Competitive Strategy (BCSI), discussed credit market and macroeconomic issues.

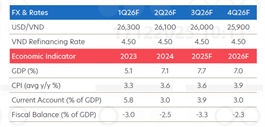

BCSI Director Dr Võ Trí Thành said that Việt Nam is aiming for high economic growth in the next few years. However, this growth can't just be rapid — it also needs to be sustainable, inclusive and green.

According to Thành, the most important foundation for meeting this goal is maintaining macroeconomic stability.

Macroeconomic stability means keeping inflation low and also maintaining a sound financial and banking system, with stable balance of payments and other fundamental and interconnecting economic elements, requiring a comprehensive approach in policy planning and implementation.

In this context, credit has become a crucial issue as Việt Nam’s financial system still relies heavily on banks and credit continues to be a vital driver for growth.

Thành emphasised the need for a flexible and cautious credit approach to meet short-term requirements in the next year, while also ensuring medium- and long-term goals connected to reforms and restructuring of the financial and banking systems.

Dr Cấn Văn Lực, Chief Economist at BIDV and member of the Prime Minister's Policy Advisory Council, told the forum that as Việt Nam aims to become a developed country with high income by 2045, its new development model must shift from relying on capital and labour to an emphasis on science and technology, innovation, institutional reform and productivity.

Instead of following a sequential path from investment and capital injection to innovation, Việt Nam needs to combine all three elements simultaneously to leap ahead.

According to Lực, high credit growth amid high inflation will reduce the effectiveness of promoting economic growth, showing that macroeconomic stability remains a prerequisite.

The quality of economic growth largely depends on the credit and investment structure. Currently, about 80 per cent of public investment capital is allocated to transportation infrastructure, while health care and education account for 15 per cent, and science and technology only about 0.5 per cent.

Improving investment efficiency and adjusting the capital structure appropriately is therefore more important than simply expanding the scale of credit, Lực said.

Experts at the forum also agreed that to reduce pressure on bank credit and improve the quality of economic growth, it is necessary to accelerate financial institutional reforms, with a focus on developing a more balanced financial market and promoting the capital market, bond market and derivatives market.

Diversifying financial institutions, such as investment funds and pension funds, will also be essential, along with completing the legal framework for new financial models such as green finance, digital finance, carbon markets and international financial centres.

- 10:32 25/12/2025