Government moves to establish International Financial Centre

Government moves to establish International Financial Centre

The government has formally announced the establishment of an International Financial Centre (IFC), signalling a major policy push to elevate the country’s role in regional finance.

|

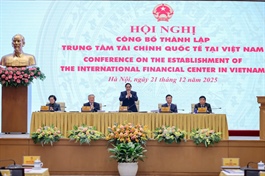

The move was unveiled at a conference chaired by Prime Minister Pham Minh Chinh on December 21, where the Ministry of Finance (MoF) declared the IFC a strategic institutional initiative aimed at mobilising resources, accelerating economic restructuring, and lifting productivity, efficiency, and national competitiveness.

"The government reaffirms its commitment to building a stable, transparent, safe and investor-friendly financial environment. Vietnam stands ready to accompany, cooperate and share development opportunities," the MoF stated in the press release.

At the event, Minister of Finance Nguyen Van Thang announced the Decision to establish the Governing Council of the IFC. The chair of the council is Standing Deputy Prime Minister Nguyen Hoa Binh.

The vice chairs of the Governing Council include ministers, heads of agencies, and leaders of local authorities, namely: Minister of Finance Nguyen Van Thang; Governor of the State Bank of Vietnam Nguyen Thi Hong; Chairman of the Ho Chi Minh City People’s Committee Nguyen Van Duoc; and Chairman of the Danang People’s Committee Pham Duc An.

Members of the council include Deputy Minister of Justice Nguyen Thanh Tinh; Deputy Minister of Home Affairs Nguyen Manh Khuong; Deputy Minister of Industry and Trade Nguyen Sinh Nhat Tan; and Deputy Minister of Agriculture and Environment Nguyen Hoang Hiep.

The IFC in Vietnam was established pursuant to a National Assembly Resolution dated 27 June. On 18 December, the government issued Decree No.323/2025/ND-CP on the establishment of the IFC in Vietnam.

The IFC operates under a “one centre, two destinations” model, located in Ho Chi Minh City and Danang. Ho Chi Minh City will serve as a large-scale financial hub, with a strong focus on capital markets, including equities, bonds, banking, fund management and listing services. Danang will concentrate on financial services linked to logistics, maritime activities, free trade and industrial-agricultural supply chains. The planned area of the IFC is 899 ha in Ho Chi Minh City and 300 ha in Danang.

According to the government’s decree, the operating regulations of the IFC are approved by the Governing Council and applied uniformly across both locations. All standards, regulations, procedures, operational rules, professional forms and licensing criteria are likewise applied simultaneously at both sites.

The Governing Council is tasked with conducting a preliminary review, evaluating operations and reporting to the government on the performance of the IFC. Where necessary, restructuring plans may be proposed towards a more streamlined and unified model, subject to safety and efficiency conditions and ensuring uninterrupted operations at both locations.

In parallel, the people’s committees of Ho Chi Minh City and Danang will update and integrate relevant provisions into regional and urban planning to ensure sufficient land allocation for the establishment and operation of the IFC within their jurisdictions.

- 21:00 21/12/2025