Credit growth expected to reach 20 per cent in 2026

Credit growth expected to reach 20 per cent in 2026

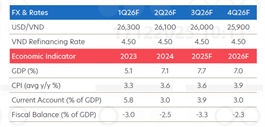

Credit growth in 2026 is expected to be around 20 per cent, driven by public investment and the recovery of production and business activities.

Customers conduct transactions at a Techcombank office. Banks with advantages in high Current Account Savings Account ratios, like Techcombank, will likely see better credit growth in 2026. Photo cafef.vn |

Credit growth in 2026 is expected to be around 20 per cent, driven by public investment and the recovery of production and business activities, analysts have predicted.

In a newly released 2026 banking industry outlook report, analysts from MB Securities Company (MBS) said that credit has increased rapidly this year and could reach approximately 20 per cent as the year ends.

The 20 per cent rate is expected to remain in place next year to support the nation's 10 per cent GDP growth target.

Along with maintaining positive disbursement of public investment, the analysts also anticipate a more favourable credit growth for small- and medium-sized enterprises (SMEs) next year.

According to the analysts, home loan lending next year is expected to slow due to anticipated interest rate hikes following rising deposit rates, while credit will be channelled more towards production, business and public investment.

Meanwhile, consumer lending is also expected to rise following major natural disasters to help with recovery.

The MBS analysts said credit growth for listed banks in 2026 is projected to be similar to 2025, with little change in the credit landscape as competitive pressure remains high for smaller banks, primarily driven by corporate lending.

Aside from the group of banks that undertook mandatory transfers of weak banks and were granted higher credit, MBS believes that several institutions will see better credit growth in 2026.

These include banks whose loan portfolios are driven by corporate clients, as credit will continue to be primarily focused on this group to achieve double-digit GDP growth, and banks that possess advantages in terms of cost of capital, such as State-owned banks those with high Current Account Savings Account ratios, like Techcombank and MB.

As for net interest margin (NIM), MBS forecasts that the NIM of the entire banking industry in 2026 will remain flat or slightly decrease compared to 2025.

Small and medium-sized banks, which face competitive pressure to lower interest rates to increase lending targets, may record a decrease in NIM compared to 2025.

Banks that saw significantly declining NIM in 2025, such as ACB, HDBank, VIB and Techcombank, will have a better NIM recovery than the rest in 2026, MBS said.

- 09:45 24/12/2025