Việt Nam stocks enter “megatrend” cycle amid economic momentum

Việt Nam stocks enter “megatrend” cycle amid economic momentum

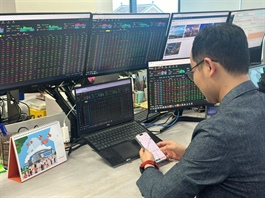

Việt Nam’s stock market is poised for a strong performance in the second half of 2025, supported by macroeconomic stability, policy reforms, and continued access to low-cost capital, market analysts said at a forum on Thursday.

Speakers at the seminar “Stock Market Outlook 2025: Shaping a New Growth Cycle from Domestic Drivers,” on Thursday in HCM City. — Photo courtesy of VFS Securities |

New Growth Cycle from Domestic Drivers,” Nguyễn Minh Hoàng, director of research at VFS Securities, said the VN-Index has rebounded sharply following earlier volatility caused by geopolitical tensions and US trade measures. The benchmark index recently surpassed 1,400 points, reflecting improving investor sentiment.

“Despite global headwinds and tariff-related uncertainties in the first half, the market has regained momentum as institutional reforms begin to take effect,” he said.

The VN-Index has gained more than 6 per cent since the beginning of July, bolstered by progress in trade negotiations and Việt Nam’s increasing integration into global supply chains.

The market is entering a “megatrend” phase, similar to the rally seen in 2021-2022, with capital inflows expected to continue, according to Hoàng.

He added the VN-Index could reach 1,600 points by year-end, driven by improving corporate earnings and a rise in the market’s forward price-to-earnings (P/E) ratio from 13 to 15.

Real estate stocks are among the top beneficiaries of the current cycle, supported by policy shifts, stable interest rates, and ongoing legal reforms that are unlocking delayed projects.

Developers are also increasing borrowing to resume construction, leading to a rise in long-term inventories and land-use values.

He also noted that corporate bond risks have eased, and recent legislative changes, including the codification of provisions in a National Assembly resolution, are expected to help banks more effectively resolve non-performing loans, thereby lowering borrowing costs and improving credit access for key sectors such as real estate.

Growth forecasts

Also speaking at the event, Dr. Cấn Văn Lực, chief economist at BIDV, said Việt Nam’s GDP expanded by 7.52 per cent in the first half of 2025, with growth driven by both supply- and demand-side improvements, ongoing reforms, and administrative streamlining.

Lực expects full-year GDP growth to reach 7.5-7.7 per cent, with a potential acceleration to 9-10 per cent in 2026.

These figures would place Việt Nam among the world’s fastest-growing economies.

He added that inflation and exchange rates remain within manageable levels, but several risks persist, including geopolitical tensions, soft private investment, uneven public spending disbursement, and growing pressure from US retaliatory tariffs.

Lực also warned that such tariffs could negatively affect exports, reduce foreign direct investment (FDI), and increase competition from goods redirected from other markets into Việt Nam.

To counter these risks, he called for a stronger trade dialogue with the US, accelerated implementation of support policies for impacted sectors, and a renewed focus on trade balance.

Lực also advocated for broader economic restructuring to enhance domestic resilience and competitiveness, including strengthening consumer demand, boosting investment, and diversifying growth drivers such as exports and services.

“Vietnamese businesses should prioritise digital transformation, green technologies, market diversification, and capacity building to navigate upcoming challenges and capture emerging opportunities,” he said.

The event was organised by VFS Securities, a well-established Vietnamese brokerage firm offering a wide range of investment and advisory services.

- 15:35 18/07/2025