Only profitable securities sales should be taxable: VAFI

Only profitable securities sales should be taxable: VAFI

The proposal was made in VAFI's comments on a draft decree amending and supplementing Decree 126/2020/NĐ-CP detailing a number of articles of the Law on Tax Administration and the Draft Law on Personal Income Tax.

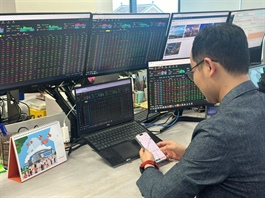

Currently, income tax must still be paid on around 70 per cent of loss-making stock investment transactions. — Photo cafef.vn |

The Việt Nam Association of Financial Investors (VAFI) proposes applying a new tax calculation method under which only securities transactions that make a profit for investors are taxable.

Currently, income tax must still be paid on around 70 per cent of loss-making stock investment transactions.

The proposal was made in VAFI's comments on a draft decree amending and supplementing Decree 126/2020/NĐ-CP detailing a number of articles of the Law on Tax Administration and the Draft Law on Personal Income Tax.

Under the proposal, which has so far been submitted to the Prime Minister, the Government Office and the Ministry of Finance, VAFI proposes applying a capital gains tax on calculating personal income tax for stock transfer transactions.

According to VAFI, investors in Việt Nam currently have to pay two types of personal income tax when selling bonus shares, including a lump-sum tax of 0.1 per cent on the total value of stock sold and 5 per cent on the total value of bonus shares at the par value of VNĐ10,000 per share, regardless of whether holding bonus shares is profitable or unprofitable. This is a major drawback.

The method of calculating lump-sum tax is usually only applied in recently launched stock markets. Though the method’s advantage is simplicity, loss-making securities transactions still have to pay tax.

Meanwhile, under capital gains tax rules, only stock transactions that make a profit are subject to personal income tax.

VAFI therefore recommends adding a capital gains tax to the draft Personal Income Tax Law 2025 for securities transactions on the stock market.

- 15:34 15/07/2025