Vietnam ready to reform and improve stock market

Vietnam ready to reform and improve stock market

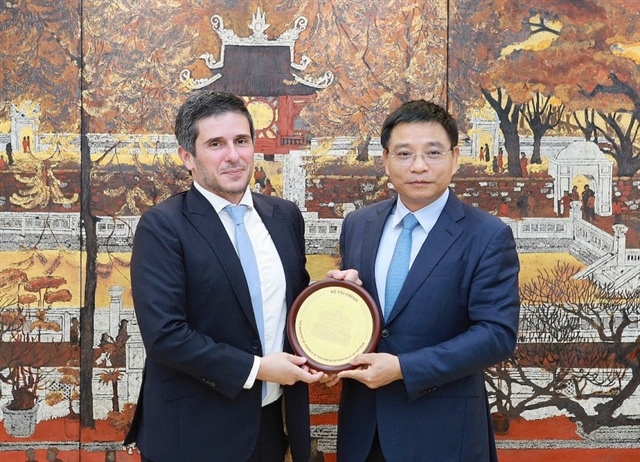

Minister of Finance Nguyen Van Thang had a meeting with representatives of FTSE Russell on July 17 to discuss and assess Vietnam's capital markets for a potential reclassification.

|

Thang highly appreciated FTSE Russell's efforts to coordinate with authorities and market members to identify shortcomings in the operating mechanism, improve monitoring efficiency, and accelerate market reform towards transparency and international standards.

FTSE Russell's recommendations and contributions have contributed to building a modern, sustainable, and more attractive Vietnamese financial market for domestic and foreign investors.

The minister emphasised that Vietnam is aiming for stable, sustainable, and high-quality economic growth in the 2025-2030 period, with a GDP growth target of at least 8 per cent in 2025, and double digits in the coming period. To achieve these goals, the government has implemented multiple solutions, such as administrative procedure reform and organisational restructuring.

To mobilise resources for rapid and sustainable economic development, a developed stock market is the foundation for attracting long-term capital flows, while upgrading the Vietnamese stock market from frontier to emerging would be a natural result of the process of building a fair, transparent, and efficient market.

Gerald Toledano, FTSE Russell's global head of equity and multi-asset, said attention is being paid to the development of the Vietnamese stock market, especially as the country has been on a waiting list for consideration to upgrade from a frontier market to an emerging market since 2018.

"The decision to upgrade depends on the assessments of foreign investment organisations. FTSE has found that foreign investment organisations have positively assessed the reforms that Vietnam has committed to and implemented," he said.

According to Morgan Stanley, Vietnam is one of the markets with the highest liquidity in the ASEAN region. Toledano assessed that this supports the consideration of upgrading the market, as well as highly appreciated the progress of the implementation and the commitments and support of the Ministry of Finance (MoF) and the State Securities Commission (SSC).

In addition, he gave some recommendations to increase the attractiveness of the market and improve the experience for investors. FTSE Russell also proposed cooperating with the Vietnam Stock Exchange to develop new high-quality indexes and training activities to enhance the financial sector's capacity.

Minister of Finance Nguyen Van Thang and Gerald Toledano, FTSE Russell's global head of equity and multi-asset |

Minister Thang shared important content that the MoF and the SSC are implementing. Regarding creating goods for the stock market, the MoF is finalising a draft decree to publicise and make transparent the foreign ownership ratio and eliminate inappropriate regulations. The ministry is also conducting a comprehensive review to accelerate the equitisation process and divestment of state capital in some enterprises. The MoF has assigned the SSC to research and propose new products under international practices and market demand.

Regarding administrative procedures for foreign investors, the MoF has closely coordinated with the State Bank to simplify the process, shorten processing time, and remove practical obstacles. Currently, a draft circular is being compiled, with many significant improvements. The ministry is also accelerating administrative reform in the securities sector through digital technology.

Vietnam has completed technical infrastructure with the official operation of the KRX system since May. The MoF has assigned the SSC to direct the Securities Depository and Clearing Corporation to develop a roadmap for implementing the central clearing counterparty (CCP), expected to be put into operation from early 2027.

"Vietnam especially encourages the development of high-quality indexes that meet the diverse needs of investors, while promoting training cooperation programmes, knowledge, and technology transfer to improve the capacity of financial and securities experts, contributing to building a modern, transparent, and deeply integrated Vietnamese capital market," Thang said.

He also welcomed FTSE Russell's initiative to expand the index sets suitable for the Vietnamese market. "The MoF should facilitate extensive cooperation between the SSC, domestic financial market institutions, FTSE Russell, and global financial organisations," the minister emphasised.

Thang expressed his belief that with close and active cooperation from FTSE Russell and the determination to reform of the government, the Vietnamese stock market will increasingly meet the criteria of an emerging market.

"This is an important milestone for Vietnam and a positive signal for global investors looking for stable, potential, and transparent investment destinations in the Asian region," he said.

- 14:53 18/07/2025