Emphasis outlined for market upgrade

Emphasis outlined for market upgrade

With FTSE Russell’s September review fast approaching, the Vietnamese government is ramping up structural reforms and regulatory efforts in a determined bid to secure an upgrade for its stock market from frontier to emerging status.

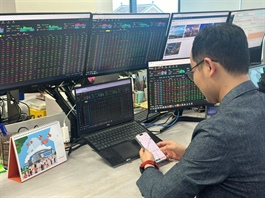

Commitments have been reiterated on the market upgrade process, Photo: Le Toan |

Prime Minister Pham Minh Chinh on July 6 called for enhanced policy coordination in monetary and fiscal management, while placing special emphasis on the implementation of measures necessary for the market upgrade. His directive urges relevant ministries and agencies to actively dismantle lingering bottlenecks, particularly those tied to transaction procedures, foreign investor rights, and market transparency.

In response to this directive and as part of ongoing reform efforts, the Ministry of Finance (MoF) has reiterated its commitment to the upgrade process.

On July 2, Deputy Minister of Finance Nguyen Duc Chi reaffirmed that upgrading Vietnam’s stock market remains a key government priority, carried out in a methodical and coordinated manner. He noted that the MoF and the State Securities Commission (SSC) are closely working with other authorities to fine-tune legal regulations, modernise infrastructure, and meet the stringent criteria set by international organisations such as MSCI and FTSE Russell.

“Improving the investor experience, especially for foreign institutions, is a core condition for market upgrading,” Chi stressed. “The goal is not only to secure technical compliance, but also to enhance Vietnam’s position as a more accessible and transparent investment destination.”

In parallel, SSC vice chairman Hoang Van Thu provided a detailed update on ongoing reforms aligned with the stock market development strategy to 2030. The rollout of the KRX trading platform in May marked a major milestone in technology modernisation. Complementing this, circulars on margin trading and information disclosure have been introduced to align legal regulations with international practices.

“The regulatory framework has seen tangible progress, but we acknowledge that some requirements for the upgrade are still pending finalisation,” Thu said, pointing to ongoing amendments and the planned introduction of a central counterparty clearing model beyond the derivatives market.

The MoF is currently drafting a decree which will establish a legal framework for the clearing mechanism, addressing concerns around post-trade settlement risks and enhancing market efficiency. In parallel, the SSC is working on the implementation of omnibus accounts, a key structure that simplifies the trading experience for foreign institutional investors and is standard in emerging markets.

On the market front, optimism appears to be building. At an investment seminar in Hanoi on July 8, Tran Hoang Son, director of Market Strategy at VPBank Securities, noted that the VN-Index has bounced back from its dip in April and is now exceeding recent short-term highs.

“Liquidity has improved significantly, and investor confidence is clearly returning, as shown by the number of trading accounts surpassing 10 million,” said Son.

He added that the market remains attractively priced. The current price-to-earnings ratio is around 14 times, lower than the 10-year average of 16.6. The forward ratio is estimated at 10-11 times, indicating there is still room for growth. “Low valuations and rising investor interest are setting the stage for further capital inflows into the stock market,” he said.

Son also highlighted a pipeline of new listings and initial public offerings expected between now and 2027. These could contribute an estimated $47.5 billion in market capitalisation, particularly in sectors such as finance, consumer goods, and ICT.

“Vietnam is currently fulfilling seven out of nine criteria set by FTSE for emerging market status,” he noted. “We believe there is a 70 per cent likelihood of the upgrade being confirmed in September, although there remains a chance that the final decision could be deferred to March 2026 due to settlement timeline differences under the new KRX system.”

Should the upgrade be realised, VPBankS projects capital inflows of between $3-7 billion, including both passive and active investment. This would boost liquidity and also deepen the investor base and increase scrutiny over corporate governance, reporting standards, and transparency.

Pham Luu Hung, chief economist at SSI Research, assessed the upgrade probability at closer to 90 per cent. “We estimate that 20-30 Vietnamese stocks could be included in FTSE’s index baskets, with large-cap stocks such as VNM, HPG, SSI, and several Vingroup affiliates likely to see strong inflows,” Hung told VIR.

He added that top securities firms with large foreign trading volumes, such as SSI, VCI, and HCM, would be among the beneficiaries. “This upgrade will bring in new capital and also shift the overall perception of Vietnam’s market in the eyes of foreign institutions,” Hung emphasised.

He further noted that the expected rise in foreign investment will also positively impact Vietnam’s financial services sector, especially securities companies and asset managers. “As more international investors enter the market, there will be growing demand for better risk management tools, hedging products, and clearer financial reports. This, in turn, will help improve the overall quality and development of Vietnam’s capital market,” he said.

- 11:10 16/07/2025