Strong selling force causes VN-Index to finish lower

Strong selling force causes VN-Index to finish lower

As the VN-Index approached the critical threshold of 1,500 points, anticipated corrections appeared, aligning with previous forecasts from market analysts.

Inside a Gelex Group warehouse. Shares of the company hit the maximum daily gain of 7 per cent on Tuesday, cushioning the index's losses. — Photo courtesy of the company |

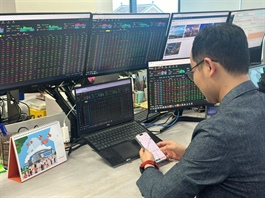

The Vietnamese stock market ended mixed on Tuesday as strong selling pressure in the last trading minutes caused the VN-Index to break its upward streak.

Investors entered the session with enthusiasm, buoyed by a recent surge in market activity and a robust return of capital flow. However, as the VN-Index approached the critical threshold of 1,500 points, anticipated corrections appeared, aligning with previous forecasts from market analysts.

Selling activity surged just before the market entered its final matching phase, with a notable concentration on large-cap stocks.

By the end of the trading session, the VN-Index on the Ho Chi Minh Stock Exchange (HoSE) had declined by 9.77 points, or 0.66 per cent, closing at 1,460.65 points. The move snapped the index's rally streak of seven days.

The market's breadth fell into the negative territory, with 136 stocks increasing while 190 ticker symbols declined.

Trading volume on the southern bourse for the day reached over 1.4 billion shares, with a total value of VNĐ34.5 trillion (US$1.3 billion), up nearly 10 per cent from the previous session.

The VN30-Index also finished lower at 1,593.84 points, down 11.82 points or 0.74 per cent. In the VN30 basket, 25 stocks went down, although most declines were modest, while five rose.

In previous trades, Vingroup (VIC) stocks had been the driving force behind the index's rise, but today, VIC and Vinhomes (VHM) negatively impacted market performance.

Conversely, the index found support from stocks like Gelex Electricity JSC (GEE), Gelex Group (GEX), LPBank (LPB), SSI Securities Corporation (SSI) and Orient Commercial Joint Stock Bank (OCB), with GEE hitting the ceiling price.

On the Hanoi Stock Exchange (HNX), the HNX-Index extended gains by 0.72 points, or 0.3 per cent, to 240.33 points.

In contrast to domestic selling, foreign investors aggressively increased their buying activity, resulting in net purchase values exceeding VNĐ1 trillion on the HoSE during the session. Notably, SSI and Dat Xanh Group (DXG) each saw net purchases of over VNĐ200 billion.

Many analysts believe this corrective phase is necessary to solidify the market's medium- to long-term upward trajectory, especially after the VN-Index had seen a consecutive rise over seven sessions, leading to significant profit-taking pressure.

From a market psychology perspective, technical analysts from major securities firms generally agree that technical factors are positively reinforcing the VN-Index's medium- to long-term trends.

As the index has increased nearly 33 per cent since its low in April, a short-term correction appears inevitable as current valuation levels have become less attractive.

- 17:21 15/07/2025