E-invoicing rollout set to elevate stock market transparency

E-invoicing rollout set to elevate stock market transparency

Under the new system, which took effect June 1, investors across all brokerage firms now have e-invoices automatically issued via email, their trading platforms or service portals — a measure that aims to standardise financial disclosure and strengthen investor protection.

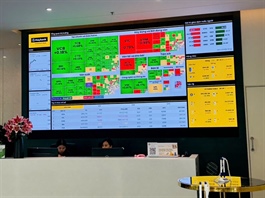

A customer conducts a transaction at a Bao Viet Securities office in Hà Nội. — VNA/VNS Photo |

The blanket introduction of electronic invoicing in the Vietnamese securities industry marks a decisive leap toward regulatory modernisation and deeper market transparency.

Under the new system, which took effect June 1, investors across all brokerage firms now have e-invoices automatically issued via email, their trading platforms or service portals — a measure that aims to standardise financial disclosure and strengthen investor protection.

Insiders predict that e-invoicing will not only streamline internal accounting and tax compliance, but also put in place the digital infrastructure necessary for Việt Nam to integrate more fully into international capital markets.

"We expect that applying e-invoices for brokerage services will produce a profound shift — not only at a technical level, but in managerial thinking and stock market operations," said Nguyễn Thùy Linh, head of the Finance and Accounting Department at PVI Fund Management Company.

"It is essential for the national digital transformation and it boosts supervisory effectiveness by tax authorities."

The implementation touches a broad network: securities firms, custodial banks, fund management companies and derivatives clearing houses are all now issuing digital receipts for services ranging from trading and custody to margin management.

This connectivity ensures seamless integration with tax databases, reducing manual errors, reinforcing compliance and increasing the probability of audits catching discrepancies early.

While larger brokers have largely completed their e-invoicing systems, often as part of their digital upgrades tied to the KRX trading platform, small-sized firms face a more complex path.

According to Kafi Securities CEO Trịnh Thanh Cần, the surge in daily trading volumes poses a significant challenge.

"Issuing invoices for each transaction without an automated system is simply unfeasible," he warned.

Online storage solutions and cloud-based client portals are emerging as practical alternatives. These allow investors to independently access their invoices while simplifying data management for firms. Yet, this innovation requires uniform regulatory standards.

"It is not just about technology. It is a foundation for integrating Việt Nam’s capital markets into regional and global markets," Linh noted.

For securities companies, the challenges are operational and educational. Firms must upgrade systems to generate real-time e-invoices and train both staff and clients in using the new platforms.

A senior executive from a top-five brokerage highlighted initial pains, saying that issuing millions of invoices per trading session "puts intense pressure on data processing and management systems".

Despite the challenges, the shift is expected to deliver long-term benefits. E-invoicing cuts costs on printing, storage and manual accounting while providing a robust audit trail.

More importantly for investors, it brings clarity — fees and taxes are now traceable and verifiable. Data-driven oversight also helps prevent tax evasion and enhances financial discipline amid rising capital market activity.

Analysts view this point-of-sale, transaction-level transparency as a significant step in Việt Nam’s ambition to upgrade its stock market infrastructure.

Not only does it align with broader tax modernisation efforts but it also reinforces investor trust, especially among institutional and foreign players increasingly governed by ESG and compliance mandates.

Still, the transition poses short-term friction. Firms must ensure that invoice issuance remains uninterrupted, especially during peak trading periods.

As firms work to integrate e-invoicing into trading systems, tax authorities and market participants are expected to collaborate closely to ensure standardisation and smooth execution.

- 06:00 11/07/2025