CII: Notice of the 8th bond interest payment and conversion implementation (CII42013)

CII: Notice of the 8th bond interest payment and conversion implementation (CII42013)

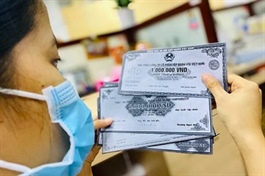

Notice of the 8th bond interest payment and conversion implementation (CII42013) of Ho Chi Minh City Infrastructure Investment Joint Stock Company as follows:

| Attached Files: |

| 20241004_CII 241004 Notice of the 8th bond interest payment and conversion implementation (CII42013) - QN.pdf |

HOSE