GLH121026: 27/09/2024, delisting date of bonds

GLH121026: 27/09/2024, delisting date of bonds

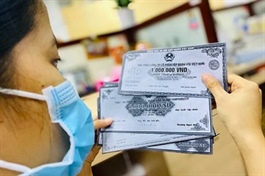

On 20/09//2024, HNX officially admitted the delisting of the following bond:

- Bond code: GLH121026

- Name of issuer: GLEXHOMES Joint Stock Company

- Par value: VND100,000/bond

- Number of delisted bonds: 5,000,000 bonds

- Value of delisted bonds (by par value): VND500,000,000,000

- Delisting date: 27/09/2024

- Last trading day on HNX: 26/09/2024

- Reason for delisting: due to the bond's maturity (based on Point a, Clause 5, Article 120, Decree No.155/ 2020/ ND-CP regulating the implementation of some articles of Securities Law dated 31 Dec 2020).

HNX