VN economic growth in 2026 to rely on domestic consumption

VN economic growth in 2026 to rely on domestic consumption

Việt Nam’s growth prospects for 2026 will largely depend on the recovery of domestic demand, the effectiveness of policy implementation and the continued role of public investment as a key growth driver.

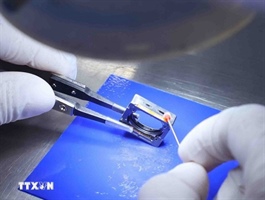

Domestic consumption is said to be an important factor for Việt Nam's 2026 economic growth. — VNA/VNS Photo |

Amid growing uncertainty in the global 2026 economic outlook, experts say Việt Nam’s growth prospects will largely depend on the recovery of domestic consumption, the effectiveness of policy implementation and the continued role of public investment as a key growth driver.

At the webinar on Việt Nam’s Economic Outlook for 2026 held on January 14, Nguyễn Xuân Thành, Senior Lecturer at the Fulbright School of Public Policy and Management, said that domestic consumption is the biggest unknown factor for Việt Nam’s economic growth in 2026, as consumer confidence and demand see both recovery opportunities and lingering risks.

Thành said the outlook for domestic consumption hinges largely on public confidence, although several positive signals have begun to emerge.

The labour market has shown signs of improvement, with employment in industrial zones recovering, informal service jobs rebounding alongside tourism, and incomes among the upper-middle class becoming more stable.

Meanwhile, rising property prices have made home ownership more difficult for many, but for households that already own homes, higher asset values have helped improve confidence and willingness to spend. Savings depleted during the COVID-19 period have also been largely replenished.

The Fulbright lecturer highlighted the importance of institutional reform and policies from the State. He noted that if reform directions are translated into concrete action, particularly through increased spending on social welfare such as tuition fee exemptions and expanded health insurance coverage, consumer confidence could improve significantly.

Drawing on China’s experience, he said insufficient social welfare coverage often leads households to adopt a defensive mindset and cut back on spending.

By contrast, strong government commitment to social security could serve as a powerful catalyst for boosting domestic consumption.

Additionally, public investment will continue to be one of the main growth drivers of the economy in 2026.

However, the pace of public investment growth is unlikely to match that of 2025, as the previous year marked the end of the current term, when disbursement pressures were particularly strong.

Under the State budget plan approved by the National Assembly, public investment capital in 2026 is expected to rise by 10.3 per cent compared to 2025, reaching nearly 8 per cent of GDP, one of the highest levels in recent years.

Maintaining export growth also plays a crucial role in stabilising employment and incomes for workers in industrial zones. Stable income is the key foundation for stimulating domestic consumption, Thành stressed.

However, it is forecast to face considerable challenges. The Government targets export growth of around 8 per cent in 2026, significantly lower than the 17 per cent recorded in 2025.

This target largely depends on exports to the US not falling sharply, while shipments to other markets maintain last year’s growth momentum.

Sharing a similar view on public investment, Đinh Hồng Kỳ, chairman of the HCM City Green Business Association, said public and infrastructure investment is expected to maintain strong growth in 2026.

In southern Việt Nam, a series of major projects have been launched since early 2026, including metro lines, the underground link from HCM City to Cần Giờ, the Vũng Tàu sea-crossing bridge, Long Thành International Airport, and several expressways.

According to Kỳ, once large-scale infrastructure projects enter the implementation phase, progress tends to be sustained, allowing public investment in 2026 to potentially outpace the previous year and continue serving as an important engine for economic growth.

- 09:10 15/01/2026