Venture capital falls for fifth straight year in 2025

Venture capital falls for fifth straight year in 2025

This downturn continues the trend of decline that began in 2021 amid tighter global liquidity and a structural reset in investor risk appetite, according to the 'Vietnam Tech & Venture Capital Outlook 2025' report published by VinVentures.

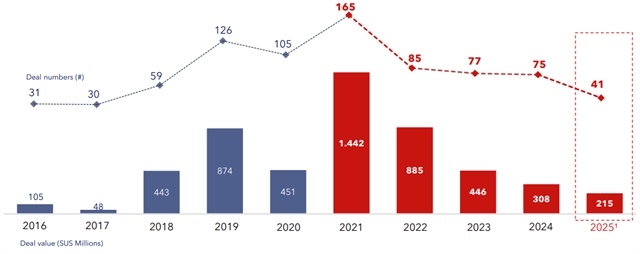

Number and value of venture capital deals in Việt Nam last year. Source: VinVentures |

The Vietnamese venture capital landscape faced significant challenges in 2025, with the number of investment deals plummeting to approximately 41 transactions, alongside total funding reaching around US$215 million.

This downturn continues the trend of decline that began in 2021 amid tighter global liquidity and a structural reset in investor risk appetite, according to the 'Vietnam Tech & Venture Capital Outlook 2025' report published by VinVentures.

Despite the downturn in overall transactions, a noteworthy trend has emerged: capital is becoming increasingly concentrated and selective.

A significant portion of investments is now directed towards later-stage funding rounds, typically ranging from $5 to 10 million. This indicates a shift in strategy, with funds favouring investments in companies that have already demonstrated market traction and possess relatively clear business models.

This cautious approach resembles private equity investment strategies, focusing on sectors deemed more reliable and capable of generating cash flow, such as edtech, climate technology and e-commerce/retail.

VinVentures observes that Vietnamese venture capital funds are shrinking and conserving their existing portfolios. Approximately 60 per cent of capital resources are now allocated to follow-up funding rounds and bridge financing for previously invested companies, rather than pursuing new deals. This defensive strategy demonstrates investors' prioritisation of stability and risk minimisation amid uncertain exit prospects.

As a result, the trend has led to a continued decline in ultra-small investments. The transaction structure reflects a notable shift, with deals sized between $1-5 million increasing from 21 per cent to 43 per cent, while smaller amounts have seen a drastic reduction.

In 2025, the failure rate among startups remains high, with only about 29.5 per cent successfully securing funding. Notably, 70 per cent of those that did raise funds reported generating revenue, underscoring the crucial need for evidence of market appeal as a prerequisite for capital access.

Meanwhile, the domestic IPO market showed signs of improvement over the past year, highlighted by several large listings in the financial sector, such as Techcom Securities and VPBank Securities. However, the absence of successful tech IPOs continues to dampen venture capital investor sentiment, alongside a lack of clear recoveries in the M&A market and stock exchange.

Experts suggest that with fewer active investors, 2025's funding is concentrated primarily on sectors that have demonstrated effectiveness and measurable outcomes.

Software-as-a-Service (SaaS) and enterprise artificial intelligence continue to represent a significant proportion of early-stage deals, with funding heavily focused on seed to pre-Series A rounds, typically in the range of 0.5-3 million, aimed at validating market demand and refining business models.

The healthcare technology sector also witnessed a more stringent selection process from investors this year.

Most funded deals involved companies with established operations and stable appeal in high-demand, sustainably growing segments, such as early detection and preventive healthcare.

In the macroeconomic context, Việt Nam remains one of the most promising markets in Southeast Asia, characterised by stable trade activity, record levels of FDI, controlled inflation and clear policy drivers from regulatory authorities.

Initiatives like the establishment of a national venture capital fund, enhancements to capital markets, and a series of regulations designed to facilitate private sector development are poised to support the sector moving forward.

- 08:18 14/01/2026