Finance ministry drafts stricter rules for corporate bond market

Finance ministry drafts stricter rules for corporate bond market

The draft decree proposes clearer and stricter responsibilities for issuing companies and organisations involved in preparing and confirming issuance dossiers.

Under the proposal, issuers and individuals signing issuance documents would be legally responsible for the accuracy of the information provided. — Photo tuoitre.vn |

The Ministry of Finance has published a draft decree tightening regulations on the private placement and trading of corporate bonds, as well as the issuance of bonds on international markets, in an effort to improve transparency and strengthen investor protection.

The ministry said existing rules under Decree 153/2020/NĐ-CP and its amendments have supported medium- and long-term capital mobilisation and eased pressure on bank credit.

They have also improved information disclosure and increased the responsibility of issuers and service providers. However, after five years of implementation, several shortcomings have emerged.

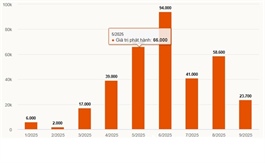

Officials noted that privately issued corporate bonds have grown rapidly but are still not a major funding channel for businesses. Some issuers have failed to fully comply with reporting and disclosure obligations, including financial statements, bond use plans and repayment schedules.

In some cases, service providers did not adequately review or verify information for issuers.

The draft decree proposes clearer and stricter responsibilities for issuing companies and organisations involved in preparing and confirming issuance dossiers. It also clarifies the role of consultants, issuing agents, auditors and credit rating agencies, requiring them to ensure information is reviewed carefully and accurately.

Under the proposal, issuers and individuals signing issuance documents would be legally responsible for the accuracy of the information provided.

The State Securities Commission would only assess the validity of registration files based on submitted documents and would not be liable for violations occurring before or after submission.

Advisory firms would be required to review and verify information carefully to ensure reasonable and prudent analysis.

Under new laws adopted in 2024 and 2025, individual professional investors will only be allowed to buy or trade privately placed corporate bonds if the bonds are credit-rated and asset-backed, or credit-rated and guaranteed by a credit institution. The ministry said this shift aims to steer individuals toward safer and more transparent investment products.

The draft also introduces stronger oversight mechanisms, giving provincial authorities more power to supervise, inspect and handle violations by issuers operating in their localities, while maintaining the principle that businesses are responsible for their own bond offerings.

The proposed decree includes eight chapters and 52 articles covering domestic and international issuance, information disclosure, reporting requirements, a dedicated information portal, supervision responsibilities, dispute settlement and penalties for violations.

The ministry said the revisions are needed to align regulations with recent legal changes and ensure consistency across the legal system, while reinforcing market discipline and investor protection.

- 12:44 27/11/2025