Payment pressure for corporate bonds to be high in December

Payment pressure for corporate bonds to be high in December

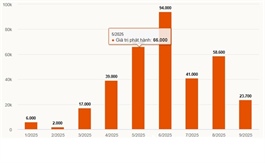

Payment for corporate bonds due in the last quarter of 2025 will be at VNĐ75.7 trillion (US$2.88 billion), of which VNĐ45 trillion will be in December alone, mainly in the real estate group.

A view of a TCO Real Estate's project. Many corporate bonds of enterprises, including TCO, will mature with a total value of up to VNĐ11.9 trillion in the coming months. Photo cafef.vn |

Corporate bond payments due in the final quarter of 2025 will total VNĐ75.7 trillion (US$2.88 billion), with VNĐ45 trillion due in December alone, mainly in the real estate sector.

Data from FiinPro-X, the FiinGroup system, showed that issuers had paid a total of VNĐ182.4 trillion in principal and interest on corporate bonds as of October 16, nearly 72 per cent of the total value scheduled for 2025.

October payments are only around VNĐ21.7 trillion, much lower than peak months earlier in the year. Of this, the principal due from the non-bank group is estimated at VNĐ12.6 trillion, up 32 per cent from September and still largely concentrated in real estate.

The downward trend in bond payments is expected to continue in November before rising again in December.

FiinGroup noted that corporate bonds from companies including Sun Valley Investment, TCO Real Estate, VHM, Newco JSC and Phú Thọ Land will mature with a combined value of VNĐ11.9 trillion.

In the last four months of 2025, payments for corporate bonds from the non-bank group are projected at VNĐ48 trillion, with real estate alone accounting for nearly 63 per cent, highlighting persistent repayment pressure.

The non-bank sector will also face total interest payments of about VNĐ21.9 trillion over the same period, of which real estate represents nearly 54 per cent, showing that financial strain in the industry remains significant.

FiinGroup’s report also projected that in the first half of 2026, the non-banking group will have around VNĐ81.5 trillion of bonds maturing, with real estate continuing to dominate at 71 per cent.

- 15:47 24/10/2025