Inspection finds major banks misused trillions of đồng from bond issues

Inspection finds major banks misused trillions of đồng from bond issues

Inspectors concluded that three of the five banks used bond proceeds for the wrong purpose.

The inspection found that ACB used VNĐ3.7 trillion raised from two bond issuances in 2018 for short- and medium-term loans, breaching its stated plan to fund medium- and long-term credit. — Photo developer.acb.com.vn |

Several major commercial banks were found to have used trillions of đồng raised from corporate bond issues for purposes other than those publicly stated, according to a report released by the Government Inspectorate on Friday.

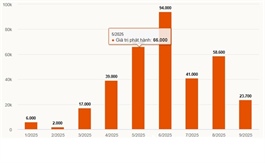

The inspection, covering the period from January 1, 2015 to June 30, 2023, examined five banks – Military Bank (MB), Asia Commercial Bank (ACB), VPBank, Vietnam International Bank (VIB) and Orient Commercial Bank (OCB) – which together issued more than VNĐ255 trillion (US$9.7 billion) in private corporate bonds.

By mid-2023, 173 bond codes with a total value of nearly VNĐ98 trillion were still outstanding.

Inspectors concluded that three of the five banks used bond proceeds for the wrong purpose.

ACB raised VNĐ3.7 trillion in two bond issuances in 2018 but later lent nearly VNĐ2.4 trillion of that amount as short-term loans, despite having announced that the funds would serve medium- and long-term credit needs.

At MB, funds from 11 bond codes worth VNĐ1.92 trillion issued in 2022 were also channelled into lending instead of the planned investment activities.

The report said the banks failed to properly track and manage the proceeds, as all bond revenue was merged into general business capital and then disbursed to borrowers.

The Inspectorate also found that several banks, including VIB and MB, failed to comply with disclosure requirements. Their information releases before issuance did not clearly specify the timeline for fund use, while ACB and MB violated deadlines for publishing some bond-related information.

The report said some banks did not prepare annual capital plans for bond issuance during 2016–19, and their data systems could not accurately distinguish bond-based funds from other lending sources.

The Government Inspectorate recommended that the Prime Minister direct the State Bank of Vietnam to strengthen oversight of bond issuance, investment and fund use by credit institutions, and to hold accountable organisations and individuals responsible for violations.

- 20:20 18/10/2025