Over $1 billion mobilised through G-bond auctions at HNX in October

Over $1 billion mobilised through G-bond auctions at HNX in October

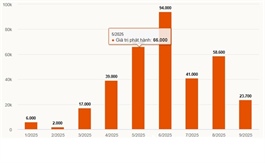

The Hanoi Stock Exchange (HNX) has announced that it held 20 government bond auctions in October, raising VNĐ27.7 trillion (US$1.1 billion).

The figure brought the State Treasury’s sum raised from government bonds in the first 10 months of 2025 to VNĐ283.4 trillion, fulfilling 56.7 per cent of the yearly plan. — VNA/VNS Photo |

The figure brought the State Treasury’s sum raised from government bonds in the first ten months of 2025 to VNĐ283.43 trillion, fulfilling 56.69 per cent of the yearly plan.

The October auctions focused on bonds with 5-, 10-, 15-, and 30-year maturities. Ten-year bonds made up 65.3 per cent of the issuance (VNĐ18.1 trillion), followed by five-year bonds at 30.6 per cent (about VNĐ8.5 trillion).

At the final auction in October, winning yields increased slightly across all tenors compared to end-September, standing at 3.14 per cent (5-year), 3.8 per cent (10-year), 3.85 per cent (15-year), and 3.89 per cent (30-year).

On the secondary market, the total listed value of government bonds hit VNĐ2.47 quadrillion as of October 31, up 0.8 per cent from the previous month. Average daily trading value in October rose 0.6 per cent month-on-month to VNĐ16.9 trillion.

Outright transactions accounted for 72.3 per cent of the total trading value, while repos (repurchase agreements) made up 27.7 per cent.

Foreign investors’ trading represented 3.54 per cent of total market turnover, with a net purchase of VNĐ280 billion during the month.

- 12:30 06/11/2025