Corporate bond issuances surge as firms accelerate capital restructuring

Corporate bond issuances surge as firms accelerate capital restructuring

Vietnam's corporate bond market saw a surge in new issuances and early redemptions in mid-October, signalling active capital restructuring by businesses amid stable interest rates and improved liquidity.

According to a weekly report for October 13–17 by the Vietnam Bond Market Association (VBMA), the market recorded 19 corporate bond issuances worth a combined $1.002 billion. This reflects continued strong demand for capital mobilisation via bonds, especially as many firms are restructuring their funding sources ahead of the major maturity periods in 2025-2026.

|

Since the beginning of the year, the total value of corporate bond issuance has reached $18.1 billion, including 26 public offerings worth $1.97 billion, accounting for about 10.9 per cent of total issuances, and 364 private placements worth $16.13 billion, or 89.1 per cent. Notably, private placements continue to dominate the market.

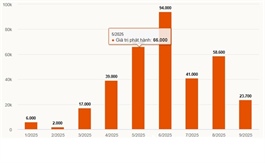

Alongside new issuances, early bond redemptions have been robust. Last week, companies repurchased $207 million worth of bonds. Cumulatively since the start of 2025, early redemptions have reached $9.75 billion, up 54.6 per cent on-year.

Banks remain the leading group, accounting for about 67 per cent of total redemptions, or roughly $6.54 billion. This trend indicates that credit institutions are proactively managing debt obligations and easing maturity pressure amid stable deposit rates and improved system liquidity.

The VBMA estimates that from now until the end of 2025, $1.42 billion worth of corporate bonds will mature. The real estate sector represents 36.5 per cent at around $519 million, followed by banks with $424 million.

In the secondary market, total transaction value for privately placed bonds since the beginning of the year has reached about $42.8 billion.

Since September 11, new regulations governing public bond offerings, under governmental Decree No.245/2025/ND-CP, amending Decree No.155/2020/ND-CP, have taken effect.

The changes mark a significant step towards completing Vietnam’s legal framework for the capital market, as the country aims to build a transparent, sustainable, and internationally aligned bond market.

Under the new rules, corporate issuers must maintain a debt-to-equity ratio not exceeding five times. The approval process for credit institutions has been simplified, while the timeframe for listing bonds on the secondary market after registration has been shortened from 90 days to 30 days, enhancing liquidity and capital turnover.

According to Nguyen Dinh Duy, director and senior analyst at Hanoi-based credit rating agency VIS Ratings, these regulatory adjustments are expected to strengthen market discipline, improve capital-raising efficiency, and lay the foundation for a more stable corporate bond market.

In the long run, issuers will gain faster, more flexible access to capital, while investors will benefit from clearer and more transparent risk information.

VIS Ratings anticipates that these reforms will drive greater efficiency and discipline in the market, paving the way for a more stable and sustainable bond market in Vietnam.

- 14:49 23/10/2025