Vietnam offers prime growth potential

Vietnam offers prime growth potential

Amid high hopes for a new growth cycle in Vietnam’s stock market, Petri Deryng, founder and portfolio manager of Finland’s PYN Elite Fund, talked about the country’s strong growth, political stability, low debt, and attractive valuations make it a prime destination for investors.

|

Vietnam’s stock market is relatively young at 25 years but has made notable progress. How does its outlook compare with others in Southeast Asia?

Vietnam’s current outlook is like holding a Royal Flush at the poker table – the strongest hand possible. While other regional markets face various challenges, Vietnam stands out with robust economic growth, firm political will, low public debt, accommodative monetary policy, and relatively modest equity valuations. These are conditions any investor would hope for.

With the VN-Index hitting record highs and foreign capital returning, what’s driving the rally, and is it sustainable?

After two sluggish years, we’re entering a robust earnings growth phase that could lift the market to much higher levels over the next 12–24 months.

Foreign investor participation remains at very low levels, but a larger wave of capital inflows is expected over the next two years, which will help drive the market to new heights.

Over the past 25 years, company numbers and market capitalisation have surged, and the market is now poised for a transformative phase with the removal of prefunding rules and the launch of a central counterparty clearing (CCP) house to enable day trading.

Once the foreign ownership limit (FOL) issue is resolved, a much larger pool of funds will be able to participate in the market. This could also prompt the government to accelerate long-awaited privatisations of state-owned enterprises.

As one of Vietnam’s most active foreign institutional investors, what key bottlenecks still need to be removed to boost foreign investor participation?

For the past decade, I’ve been somewhat frustrated by the slow pace of market modernisation. But over the last 12 months, I’ve been amazed at how decisively the authorities have addressed key issues, setting clear deadlines and working hard to deliver results.

I’m hopeful the CCP model will be in place by early 2026, enabling the matching of simultaneous sell and buy settlements. I would also urge the authorities to tackle the FOL challenge by creating a market-wide whitelist of companies without limits, with only a small ‘red list’ of specific industries or tickers retaining restrictions. If achieved, this would make Vietnam one of the most attractive markets for global institutional capital.

|

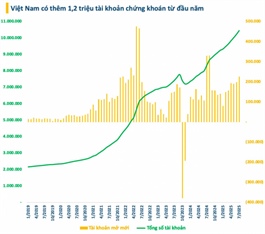

According to the Vietnam Securities Depository and Clearing Corporation, as of the end of July, the country’s stock market had nearly 10.5 million accounts – an increase of 226,300 from June, the highest in a year, and up by nearly 1.2 million since the start of 2025. This underscores the growing appeal of listed companies. July also marked a strong return of foreign capital, with overseas investors net buying more than $340 million across the market. The inflow was larger in value but also broader in scope, focusing on banking, real estate, retail, and infrastructure stocks – sectors highly sensitive to the economic recovery cycle. The foreign capital comeback became a major driver of the market’s breakout, freeing investor sentiment and pushing liquidity sharply higher. The average daily matched value in July jumped 76 per cent from the previous month. |

- 12:00 12/08/2025