Q2 profits surge across key sectors

Q2 profits surge across key sectors

Profit growth was broad-based across most sectors in the second quarter, with construction and building materials, logistics, and export-oriented industries standing out as the top performers.

As of August 4, a total of 1,064 listed companies, representing 98.7 per cent of the market’s total capitalisation, had released their Q2 financial statements or preliminary business results.

Total revenue in Q2 recorded a modest on-year increase of 6.9 per cent, while net profit after tax surged by 30.2 per cent compared to the same period in 2024, far exceeding the 20.9 per cent growth recorded in Q1.

The non-financial sector continued to lead growth for the fourth consecutive quarter, with net profit rising 41.7 per cent on-year in Q2. Despite being directly impacted by tariffs, export-oriented firms and industrial real estate companies still recorded impressive net profit growth of 153.6 and 63 per cent, respectively.

"Most sectors recorded positive profit growth, except for industrial goods and services. The sectors that outperformed our expectations included retail, fertilisers, utilities, banking, and construction. On the other hand, some sectors such as food and beverages and certain residential real estate stocks delivered results below expectations,” stated a report by SSI Securities.

Construction and building materials emerged as a highlight of the Q2 earnings season. Major contractors such as Coteccons and Vinaconex posted strong revenue and net profit growth, bolstered by a recovering real estate market and accelerated infrastructure investment.

"This trend also extended to building materials suppliers, with construction steel, cement, plastic pipes, and construction stone all reporting solid business results," said Pham Luu Hung, head of research at SSI Securities.

Industry leaders such as Hoa Phat Group (steel), Vicem Ha Tien (cement), Binh Minh Plastics, Tien Phong Plastic (plastic pipes), and Bien Hoa Building Materials Production and Construction (construction stone) saw their net profits grow by 39, 145, 17.7, and 35 per cent on-year, respectively.

The logistics, export, and utility sectors were clear beneficiaries of favourable market and external conditions. Logistics companies such as Gemadept Corporation, Hai An Transport & Stevedoring, and Vietnam Container Shipping, along with exporters like Vinh Hoan Corporation and Nam Viet Corporation, all posted strong profit growth in H1, driven by front-loading trends.

Textile and garment exports rose 10 per cent on-year in Q2, led by the US market, EU, and Japan. Seafood exports climbed 16.9 per cent on-year, reaching $5.2 billion, thanks to solid demand from the US, China, and Japan. Exporters also benefited from the appreciation of major foreign currencies against the VND.

“Although sector-wide revenue remained flat, utilities reported outstanding net profit growth of 72 per cent on-year in Q2, contributing around 12 per cent to overall market profit growth,” Hung said.

|

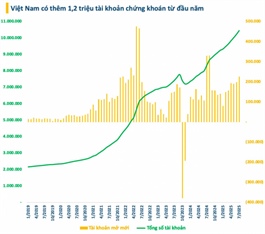

The financial sector continued to play a pivotal role in Vietnam’s profit growth during the second quarter of 2025, largely driven by financial services companies that benefited from a sharp rise in stock market liquidity.

According to SSI Research, the total after-tax profit of the financial services group reached an estimated $170 million in Q2, marking a 43 per cent increase on-year.

Cumulatively, the sector recorded approximately $300 million in profit over the first six months, representing a 20 per cent rise compared to the same period last year, a performance deemed relatively impressive by analysts.

Dao Hong Duong, director of sectors and stock analysis at VPBank Securities, highlighted two major drivers behind the robust earnings. “First, margin lending has emerged as the key growth engine for securities firms. Companies such as VIX Securities, SSI Securities, Saigon-Hanoi Securities, and VNDirect all posted strong income gains from this segment,” he said.

He also noted that a significant portion of the earnings was driven by positive fair value movements in their trading portfolios, particularly for VIX, Saigon-Hanoi Securities, and Vietcap Securities, who capitalised on favourable market conditions in the second quarter.

Meanwhile, the banking group saw more modest profit growth, underperforming the broader market due to the continued low interest rate environment that commercial banks had to maintain. However, banks remained the largest contributor to total market profit, accounting for approximately 44 per cent of after-tax earnings.

VietinBank overtook Vietcombank to become the most profitable lender in the sector during Q2, reporting a pre-tax profit of $483.9 million, a 79 per cent increase on-year. Other notable gainers included SHB, which posted a 59 per cent rise; ABBank with a 222 per cent jump; NCB with 535 per cent; and Kienlongbank with a 67 per cent increase.

“Banks under SSI’s coverage saw an average pre-tax profit increase of 16.4 per cent on-year in Q2, up from 9.3 per cent in Q1, largely driven by VietinBank and VPBank,” said Hung.

He also pointed out the growing divergence in business performance across the banking sector. “While banks such as VietinBank, ACB, VPBank, and VIB delivered better-than-expected results, others including Sacombank, MBBank, and MSB fell short of forecasts,” he added.

- 10:24 09/08/2025