New securities account openings reach 11-month high in July

New securities account openings reach 11-month high in July

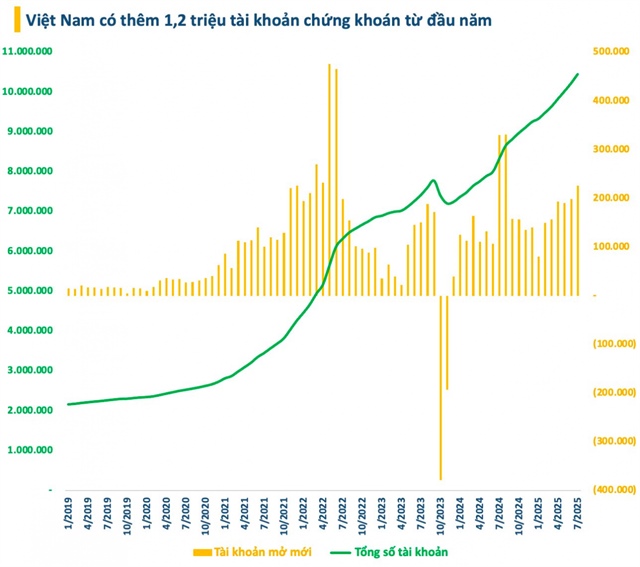

Vietnam's stock market recorded a notable increase in investor participation in July, with the number of newly opened securities accounts reaching the highest level in 11 months.

According to data from the Vietnam Securities Depository and Clearing Corporation (VSDC), more than 226,000 new accounts were opened by domestic investors during the month, marking the largest monthly increase since September 2024. By the end of July, the total number of domestic investor accounts had surpassed 10.4 million.

Securities account openings continue to rise as the VN-Index reaches a historic peak. Photo: VSDC |

The growth was primarily driven by individual investors, while institutional investors contributed 164 new accounts. Since the beginning of 2025, the domestic market has added nearly 1.2 million accounts.

With over 10.4 million domestic individual accounts now active, equivalent to more than 10 per cent of the population, Vietnam has achieved its 2025 target ahead of schedule. The next objective, set out in the national stock market development strategy to 2030, is to reach 11 million accounts by the end of the decade.

This expansion in investor base has coincided with strong market performance. The VN-Index gained more than 126 points in July, representing a 9.16 per cent increase and closing the month above the 1,500-point level. The index also reached a new all-time high on July 28, coinciding with the 25th anniversary of the stock market's establishment.

Trading activity remains elevated, with the average daily matched trading value on the Ho Chi Minh Stock Exchange (HSX) approaching $1.32 billion. Meanwhile, foreign investors returned to net buying in July, with total net inflows of approximately $348 million on HSX.

In contrast to the domestic uptrend, the number of foreign investor accounts declined slightly in July, down by 188 compared to the previous month. This decline was mainly attributed to a reduction in individual accounts, although institutional investors recorded an increase of nine accounts. As of the end of July, foreign investor accounts totalled 48,781.

Under the stock market development strategy approved in late 2023, Vietnam set a target of nine million investor accounts by 2025 and 11 million by 2030. The early fulfilment of the 2025 milestone underscores the acceleration in domestic market participation.

According to the latest market report from Mirae Asset Securities, the VN-Index is projected to maintain its upward trend into August. The expectation of Vietnam's potential inclusion in FTSE Russell's watchlist for a market status upgrade has been identified as a key supporting factor. The Ministry of Finance has also indicated that efforts to meet the remaining upgrade criteria are progressing.

Historical data from Mirae Asset further shows that August has delivered an average return of 2.21 per cent for the VN-Index over the past 25 years, with gains observed in 56 per cent of those years.

- 11:42 08/08/2025