Tariff reprieve leads to positive Q2 for Vietnam

Tariff reprieve leads to positive Q2 for Vietnam

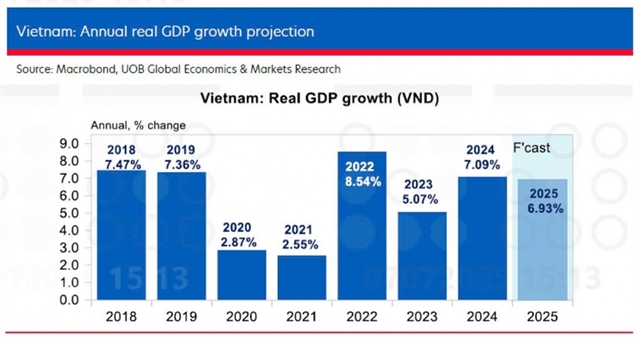

Trade negotiations with the United States in early July appeared promising for Vietnam, prompting the UOB (United Overseas Bank) to revise up its forecast for Vietnam's GDP growth in 2025 by 0.9 per cent to 6.9 per cent.

Source: UOB |

The Statistics Office under the Ministry of Finance on July 5 showed that Vietnam's real GDP growth pace rebounded sharply to 7.96 per cent on-year in Q2, well ahead of Bloomberg estimates of 6.85 per cent and UOB's calls of 6.1 per cent, and from a revised 7.05 per cent in Q1. In the first half of 2025, Vietnam's economy expanded 7.52 per cent on-year, its best performance in the first half based on data available since 2011.

The strong performance came largely on the back of frontloading of export orders as companies placed orders in the 90-day window when President Trump paused “reciprocal tariffs” with a baseline rate of 10 per cent. In the first half of the year, Vietnam's exports rose by 14.4 per cent on-year (to $219 billion), while imports surged by 17.9 per cent on-year (to $212 billion), keeping pace with the expansion of 14 per cent and 16 per cent, respectively, in 2024.

Computers and electric products remained the largest exports item in the first half, which surged 42 per cent on-year to $47.7 billion. This was followed by mobile phones, and machinery and equipment. These three categories accounted for about 46 per cent share of total exports during the period, underscoring Vietnam's dependence on those sectors. Vietnam recorded a trade surplus of $7.63 billion in the first half (lower compared to $11.6 billion in the same period last year).

Manufacturing PMI (Purchasing Managers Index) data shows that the manufacturing sector has yet to return to the expansion zone (above 50) in any meaningful way. While the PMI index improved to 48.9 in June from the slump in April (45.6) as uncertainty diminished over US trade tariffs, Vietnam has reported only one reading that is above 50 this year (March), and the index has been in contraction zone (below 50) in six out of the last seven readings. This suggests the outlook may not be as bright as the Q2 GDP data shows, as manufacturing activity remains constrained, especially by declines in new orders.

Vietnam attracted an estimated $11.7 billion in realised foreign direct investment (FDI) in the first half of 2025, an 8.1 per cent on-year increase and the highest six-month figure since 2021. Manufacturing and processing remains the top sector, receiving $9.56 billion and accounting for 81.6 per cent of total realised FDI. This was followed by real estate. Total newly registered FDI reached $21.52 billion in the first half, a gain of 32.6 per cent on-year. The strong registered capital momentum will bode well for the pipeline of realised, or actual, FDI flows in the months ahead.

After rising for three consecutive years (to $25.4 billion in 2024), the government has set targets for realised FDI of $27-28 billion in 2025, and aims to attract $38-40 billion of renewed (or registered) FDI this year after attracting $38.2 billion in 2024. However, against a backdrop of global trade tensions and the trade tariffs that will be in place, these targets appear to be ambitious as companies assess their plans in response to global evolution trade dynamics.

|

For Vietnam, the relief is that Trump declared on July 2 a 20 per cent tariff on Vietnam's imports to the US, with a 40 per cent tariff on transshipments. While significant, this is well below the initial 46 per cent tariff rate announced on April 2, and will come as a relief to exporters.

UOB has revised upward the forecast for Vietnam's GDP growth in 2025 by 0.9 per cent to 6.9 per cent. UOB is pegging growth projections for Q3 and Q4 of around 6.4 per cent. Under these conditions, realised FDI flows should reach around $20 billion this year.

- 14:10 09/07/2025