About $1.69 billion raised from government bond auctions in April

About $1.69 billion raised from government bond auctions in April

The Hà Nội Stock Exchange (HNX) held 20 government bond auctions on the primary market in April, raising over VNĐ42.4 trillion (about $1.69 billion).

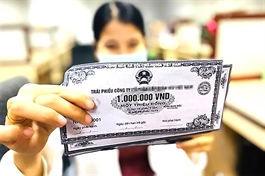

The April auctions focused on bonds with 5-, 10-, 15-, and 30-year maturities. — Photo baochinhphu.vn |

The figure brought the State Treasury’s year-to-date sum raised from government bonds to nearly VNĐ152.87 trillion, making up 30.6 per cent of the year's target.

The April auctions focused on bonds with 5-, 10-, 15-, and 30-year maturities. Ten-year bonds dominated, making up 72.2 per cent of the issuance (VNĐ30.6 trillion), followed by five-year bonds at 23.6 per cent (VNĐ10 trillion).

Yields edged up at the month’s final auction, with five-year bonds at 2.331 per cent, 10-year at 3.05 per cent, 15-year at 3.10 per cent, and 30-year at 3.28 per cent, reflecting rises of 5 to 16 basis points from March.

On the secondary market, the total listed value of government bonds hit VNĐ2.35 quadrillion as of April 29. The average daily trading value in April was over VNĐ12.5 trillion, down 24.3 per cent from the previous month. Outright transactions (conventional buy/sell) accounted for 67.7 per cent of the total market value, while repos (repurchase agreements) made up the remaining 32.3 per cent.

Foreign investors, though more active than in March, contributed just 4.3 per cent of transaction value and were net sellers, offloading VNĐ522 billion.

Yields varying across 15- to 20-year and 3- to 5-year maturities saw the sharpest hikes, averaging 3 per cent and 2.57 per cent, respectively, while 25-to 30-year and 10- to 15-year yields dipped to 3.19 per cent and 3.08 per cent.

Medium-and long-term bonds dominated April’s trading volume, with the 10-year, 5-year, and 10–15 year maturities leading the market at 32.09 per cent, 12.43 per cent, and 11.98 per cent of the total trading value, respectively.

Commercial banks remained the dominant players, handling 50.23 per cent of outright trades and 81.29 per cent of repos.

- 08:32 08/05/2025