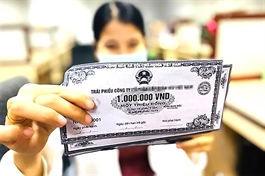

CTG: Approval of the issuance plan of tier 2 capital raising bonds via private placement in 2025

CTG: Approval of the issuance plan of tier 2 capital raising bonds via private placement in 2025

Approval of the issuance plan of tier 2 capital raising bonds via private placement in 2025 of Viet Nam Joint Stock Commercial Bank for Industry and Trade as follows:

| Attached Files: |

| 20250423_CTG 250423 Approval of the issuance plan of tier 2 capital raising bonds via private placement in 2025.pdf |

HOSE