Stock market strives to rise despite strong foreign selling

Stock market strives to rise despite strong foreign selling

A notable shift in cash flow was observed as investors flocked to steel stocks, anticipating the impending anti-dumping tariffs on imported steel.

An investor monitors the stock market. — Photo baotintuc.vn |

The Vietnamese stock market had a noteworthy week, successfully surpassing the 1,300-point mark with strong liquidity.

A notable shift in cash flow was observed as investors flocked to steel stocks, anticipating the impending anti-dumping tariffs on imported steel. As a result, several industry leaders such as TLH, NKG, HSG, VGS, and SMC posted strong gains.

This marks the sixth consecutive week of gains for the market, with the VN-Index rising 8.61 points (0.66 per cent) to close at 1,305.36 points. Trading volume on HoSE increased by 13.1 per cent compared to the previous week, while the HNX-Index also gained 1.62 points (0.6 per cent), closing at 239.19 points.

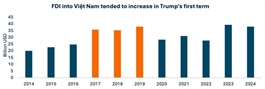

Foreign capital continued to flow out aggressively, with a notable spike in net selling towards the end of the week. Over five trading sessions, foreign investors net sold VNĐ2.7 trillion (US$105.7 million) across the market.

According to Đinh Quang Hinh, Head of Macroeconomics and Market Strategy at VNDIRECT Securities, the key theme of the past week (February 24-28) was the rapid sector rotation.

Market gains were supported by various sector-specific narratives, including anti-dumping measures in the steel industry, legal clearance for select real estate projects, and expectations for the upcoming launch of the KRX trading system.

These factors helped sustain the market’s upward momentum despite profit-taking pressures and global market volatility.

An important development last week was US President Donald Trump’s threat to impose new tariffs on European imports, reaffirming tariff hikes on Mexico and Canada, scheduled for March 4, and introducing an additional 10 per cent tariff on Chinese goods.

Although Việt Nam remains outside the list of countries targeted by US tariffs, investors should still consider risk management strategies to hedge against any potential future implications.

According to Hinh, the VN-Index is likely to retest the 1,300-point mark in early March, with short-term market direction dependent on how this level holds up. If VN-Index maintains its position above 1,300 points, the uptrend could remain intact, paving the way for further gains towards 1,320-1,340 points.

Conversely, if it fails to hold above 1,300 points, the market could see a correction back to the 1,280-point support level. Given these scenarios, investors should prepare for both possibilities by managing leverage prudently, taking profits in stocks that have surged into overbought territory, and reallocating funds to mid-cap stocks in promising sectors such as energy, residential real estate and exports.

Analysts from Nhất Việt Securities (VFS) observed that February was a strong month for the VN-Index, with a consistent uptrend throughout. By the end of February, the VN-Index had gained 40.32 points (3.19 per cent), marking its seventh attempt at breaking the 1,300-point level. However, this time, buyers demonstrated stronger commitment than in previous instances.

Despite heavy profit-taking, demand absorption remained strong, allowing the index to close at 1,305.36 points. This marked the largest gain at the 1,300-point resistance level since early 2024.

Even though foreign investors continued to sell aggressively, domestic capital has emerged as a key driver for the market.

In the short term, VFS expects the VN-Index to continue trading around the 1,300-point level, with gradually easing selling pressure. If this scenario plays out, investors can use mild pullbacks as opportunities to restructure portfolios or increase stock holdings.

With strong domestic liquidity and improving investor sentiment, the market remains well-positioned for potential further gains, provided the 1,300-point level is firmly established as a support zone.

- 06:47 03/03/2025