Market dips slightly as foreign investors extend selling streak

Market dips slightly as foreign investors extend selling streak

The stock market saw a slight downturn on Wednesday, accompanied by a drop in liquidity, as foreign investors continued their net-selling streak for the fifth consecutive session.

A VietinBank transaction office in Hà Nội City. The bank's CTG shares led the decliners on Wednesday. — Photo courtesy of VietinBank |

On the Hồ Chí Minh Stock Exchange (HoSE), the VN-Index lost 0.2 points, or 0.02 per cent, closing at 1,302.96 points.

Market breadth was negative, with 164 decliners outnumbering 143 gainers. Trading value on the southern bourse dropped to VNĐ16.6 trillion (US$649.4 million), marking a 14.8 per cent decrease from the previous session.

Meanwhile, the VN30-Index, which tracks the 30 largest-cap stocks on HoSE, remained unchanged at 1,360.56 points. Within the VN30 basket, 18 stocks declined, ten advanced and two remained unchanged.

The market’s downturn was primarily driven by losses in blue-chip banking stocks. Vietnam Joint Stock Commercial Bank For Industry And Trade (CTG) recorded the sharpest decline, slipping 1.19 per cent, erasing more than 0.6 points from the VN-Index. Bank for Foreign Trade of Việt Nam (VCB) also dropped 0.32 per cent, while the Sài Gòn Thương Tín Commercial Joint Stock Bank (STB) fell 1.78 per cent.

Despite the overall market weakness, several large-cap stocks helped limit the decline. FPT Corporation (FPT) led the market, rising 2.01 per cent, contributing more than one point to the VN-Index. Vietnam Rubber Group - Joint Stock Company (GVR) gained 1.56 per cent, while Hòa Phát Group Joint Stock Company (HPG) advanced 0.91 per cent and Vingroup Joint Stock Company (VIC) increased by 0.74 per cent.

Market analysts at Saigon - Hanoi Securities (SHS) observed that after surpassing the key psychological resistance of 1,300 points, the market’s momentum slowed, with signs of consolidation around the previous peak at 1,305 points. Liquidity declined slightly, indicating that profit-taking pressure had eased, but overall, capital inflows were still making efforts to support the market.

"The current consolidation around 1,305 points is likely to continue in the next session. If capital inflows remain stable and successfully push the market past the 1,310-point level, the market's uptrend may continue.

"Investors should closely monitor supply and demand dynamics at this resistance level to assess market strength. Short-term investment opportunities can still be explored, with a preference for stocks demonstrating strong performance from key support levels or those retracing to favourable buying zones."

On the Hà Nội Stock Exchange (HNX), the HNX-Index edged up 0.12 per cent, closing at 238.6 points. Trading value on the northern bourse exceeded VNĐ1.2 trillion, with over 68 million shares changing hands.

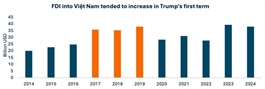

Foreign investors extended their net-selling streak to five consecutive sessions, offloading over VNĐ295 billion worth of shares on the HoSE.

- 21:51 26/02/2025