Market ends February with minor decline

Market ends February with minor decline

Market breadth was negative, with 173 decliners outnumbering 139 gainers.

A worker harvests rubber latex in Lâm Đồng Province. Vietnam Rubber Group's GVR shares led the gainers on the last trading day of February. — VNA/VNS Photo |

The stock market ended February with a slight decline, as the VN-Index retreated towards the previous peak of 1,305 points, while liquidity saw only a slight decrease compared to the previous session. Meanwhile, foreign investors continued their strong net-selling streak.

On the Hồ Chí Minh Stock Exchange (HoSE), the VN-Index dropped 2.44 points, or 0.19 per cent, closing at 1,305.36 points.

Market breadth was negative, with 173 decliners outnumbering 139 gainers. Trading value on HoSE slightly decreased to VNĐ18.6 trillion (US$727.7 million), marking a 0.5 per cent drop from the previous session.

Meanwhile, the VN30-Index, which tracks the 30 largest-cap stocks on HoSE, also declined by 7.19 points, or 0.53 per cent, to 1,356.43 points. Within the VN30 basket, 18 stocks fell, seven advanced and five remained unchanged.

The market’s decline was primarily driven by weakness in blue-chip banking stocks. The Bank for Foreign Trade of Việt Nam (VCB) recorded the sharpest drop, slipping 0.74 per cent, erasing more than 0.9 points from the VN-Index. Fortune Việt Nam Joint Stock Commercial Bank (LPB) also declined by 1.63 per cent, while the Hòa Phát Group Joint Stock Company (HPG) fell 1.58 per cent.

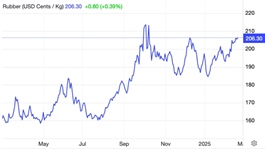

Despite overall market weakness, several large-cap stocks helped limit the decline. Việt Nam Rubber Group - Joint Stock Company (GVR) led the market, rising 2.14 per cent, contributing 0.68 points to the VN-Index. NoVa Land Investment Group Corporation (NVL) gained 4.95 per cent, while Việt Nam Commercial Joint Stock Export Import Bank (EIB) advanced 2.4 per cent and Việt Nam National Petroleum Group (PLX) increased 1.4 per cent.

Market analysts at Saigon - Hanoi Securities (SHS) noted: "The market remains in a consolidation phase near its previous peak of 1,305 points, with a small-bodied red candle indicating indecisiveness. Liquidity declined slightly from the previous session but remained at a relatively high level, suggesting that buying pressure is temporarily cooling while profit-taking continues to weigh on the market.

"This could exert short-term pressure on the market in the next session. However, this movement may only be a minor correction to attract additional capital inflows. The support zone around 1,295 - 1,300 points is expected to stabilise and provide a cushion for the market. If buying support remains strong, the market still has a chance to resume its uptrend."

"Investors should closely monitor supply and demand dynamics to assess the strength of capital inflows. Short-term buying opportunities may still be present, particularly in stocks that are showing positive technical signals from strong support zones or are currently retreating to key support levels. However, investors should consider locking in profits on stocks that have risen sharply to resistance levels to secure gains."

On the Hà Nội Stock Exchange (HNX), the HNX-Index edged down 0.08 per cent, closing at 239.19 points. Trading value on the northern exchange exceeded VNĐ1.1 trillion, with over 64 million shares traded.

Foreign investors extended their net-selling streak to seven consecutive sessions, offloading over VNĐ985 billion worth of shares on HoSE and over VNĐ62 billion on HNX.

- 19:06 28/02/2025