VN-Index tests the 1,300-point level, creating short-term investment opportunities

VN-Index tests the 1,300-point level, creating short-term investment opportunities

In the short term, the VN-Index has maintained its uptrend above the 1,280-point support level and is approaching strong resistance at 1,300 points.

An investor monitors the stock market. — Photo baotintuc.vn |

The Việt Nam stock market experienced a dynamic trading week, with the VN-Index testing the psychological resistance level of 1,300 points.

In the short term, the VN-Index has maintained its uptrend above the 1,280-point support level and is approaching strong resistance at 1,300 points. However, experts caution that this momentum may face challenges over the medium term.

The market closed the week with four consecutive gaining sessions and one slight correction, as the VN-Index ended at 1,296.75 points, increasing 20.67 points, or 1.62 per cent, compared to the previous week. Meanwhile, the HNX-Index closed at 237.57 points, rising 6.35 points, or 2.7 per cent, week-on-week.

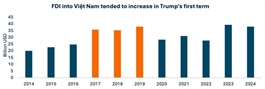

The recent market rally has been supported by both domestic and international factors. According to Đinh Quang Hinh, Head of Macroeconomics and Market Strategy at VNDIRECT Securities, concerns over tariff policies from the Trump administration have temporarily eased, and a weaker US dollar has helped alleviate pressure on the exchange rate in Việt Nam.

Additionally, positive domestic macroeconomic news has reinforced investor sentiment. Last week, the National Assembly officially approved a GDP growth target of at least 8 per cent for 2025, an ambitious goal that has fuelled expectations of stronger government policies to support economic growth.

Despite the strong rally, technical indicators suggest that the market may face increased volatility as the VN-Index nears the 1,300-point resistance level.

Phan Tấn Nhật, Head of Research at Saigon - Hà Nội Securities (SHS), pointed out that the market is beginning to experience correction pressure, with sectoral divergence becoming more apparent as the VN-Index enters resistance territory.

"The market has been on a five-week uptrend, rising from the 1,220-point zone. After a slight correction at the beginning of the week, the VN-Index rebounded and surpassed 1,285 points, marking its highest level since December 2024, supported significantly by real estate stocks. This sector has been consolidating for the past two years and is now showing signs of recovery," Nhật explained.

Market liquidity has also increased for five consecutive weeks, with trading volume on HoSE rising 22.8 per cent compared to the previous week. This surge in liquidity reflects stronger capital inflows, as several stocks saw increased buying interest at higher price levels. However, foreign investors maintained their net-selling trend, offloading VNĐ979 billion (US$ 38.3 million) worth of shares on HoSE this week.

Given the current market conditions, Đinh Quang Hinh believes that the VN-Index could continue its upward trajectory and challenge the 1,300-point resistance level in the coming week. He noted that profit-taking pressures could cause short-term volatility, but the probability of breaking through 1,300 points has increased significantly.

"Investors should take advantage of short-term corrections to increase their stock exposure, prioritising companies in sectors benefiting from government policies, such as public investment, construction materials, banking, residential real estate and securities," Hinh advised.

Meanwhile, Phan Tấn Nhật remains more cautious, suggesting that investors should wait for a clearer medium-term breakout before making aggressive moves.

"In the short term, the VN-Index is holding above the 1,280-point support level and approaching 1,300 points, which marks a significant resistance zone. This level was the peak in August 2022, as well as the highest for 2024, making it a key test for the ongoing uptrend," Nhật said.

- 19:04 24/02/2025