Retail bets on festive consumer rush

Retail bets on festive consumer rush

Increased consumer demand at the end of the year has opened up the prospect of recovery for retailers after a gloomy business year.

Japanese retailer AEON has offered a shopping stimulus programmes since early December to attract customers to its supermarkets and shopping centres.

Nguyen Thi Ngoc Hue, corporate communications and external affairs general manager of AEON Vietnam, said that it has increased the volume of goods at supermarkets by 10 per cent since the beginning of the fourth quarter and made appropriate adjustments according to customer needs.

“Customers’ spending priorities are changing; they care more about the quality and value of the product instead of the price. Demand for items related to health and welfare also increased by 10 per cent compared to before,” Hue said.

General director of AEON Vietnam, Furusawa Yasuyuki, said that AEON still identifies Vietnam as a key market in the investment and development strategy of AEON Group, second only to Japan.

“In the next few years, we still continue opening large-scale shopping malls. However, to meet the changing customer’s behaviours in post-pandemic that is to prefer convenience, we will develop multi-formats that are appropriate for the needs of local communities and actual conditions of local areas,” Yasuyki said.

According to data from the General Statistics Office, the total revenue of Vietnam’s retail and consumer industry reached nearly $190 billion in 11 months, an increase of about 9.6 per cent over the same period last year, but still about 10 per cent lower than the increase in the period of 2021-2022.

The retail market has seen many cases of decline in business, especially in electronics, after the stimulus of consumer demand and competition through sharp discounts in the second and third quarter.

The electronics retail chain Mobile World is currently considering closing about 200 stores due to poor revenue and profitability. On average this year so far, Mobile World has recorded a 14 per cent decrease in revenue over the same period and has just completed three-quarters of its business plan.

Previously, the company had to cut nearly 12,000 employees, equivalent to 14.8 per cent of personnel, due to ineffective operations. Bach Hoa Xanh, a mini supermarket chain selling fresh food and necessities, developed by Mobile World, is expected to record a loss of about $46.4 million in 2023. As of the end of October, Mobile World ran just over 1,150 stores.

Amid a difficult economy for the retail industry, food retailers are showing positive signals when they continue to expand their operational scale and achieve positive growth through a flexible business model.

WinCommerce, the retail arm of Masan Group, has recorded revenue improvement with an after-tax profit increase of about 2.2 per cent by the end of the third quarter of 2023. The result is thanks to its variety of retail models, meeting the shopping needs and price taste of many customer segments.

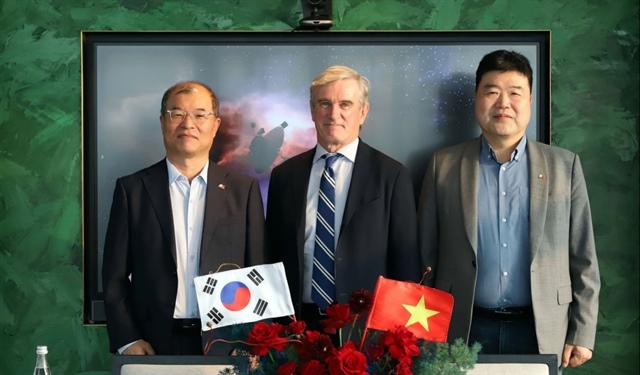

Meanwhile, short-term challenges do not seem to be affecting the expansion plans of domestic and foreign retailers. In early December, the third Emart hypermarket, a product cooperation between Thiso Retail, a member of the multi-field business group THACO and South Korea’s Emart brand, opened in Ho Chi Minh City.

Thai giant Central Retail also shared its ambition to cover the selling points in 55 localities with an additional investment plan of $844 million to promote sales in the Vietnamese market from now to 2026.

Similarly, AEON also aims to open 30 shopping centres and general department supermarkets by 2030.

Vietnam’s retail industry is worth $142 billion and is forecast to increase to $350 billion by 2025, according to Ministry of Industry and Trade forecasts.

Kantar Vietnam Market Research predicts that the peak shopping period next year will fall on January 7 to February 10 in the lead up to the Lunar New Year. It noted that attractive promotions will contribute to the year-end revenue of retailers, increasing by 15-20 per cent compared to normal months.