Concerns raised over new margin lending policy

Concerns raised over new margin lending policy

The State Securities Commission (SSC) has issued a draft regulation requiring the initial margin ratio contracted by securities companies for margin lending to be at least 60 per cent, which is expected to take effect in early February.

Margin lending is the amount of funding that an investor must personally put up from his own resources. Initial margin ratio is the portion of the purchase price that an investor has to deposit at brokers when borrowing money to purchase securities.

This also means that “margin lending contraction”, referring to the practice of using borrowed funds from a broker to trade a financial asset, which forms the collateral for the loan from the broker, would be at maximum rate of 40 per cent.

The draft policy, which was issued on January 12 to collect feedback and is expected to take effect in early February, is considered as an SSC movement to reduce potential risks in the stock market and regulate the flow of margin loans within the market.

Currently, according to the SSC Decision 87/QD-UBCK dated January 25, 2017, the initial margin ratio contracted by securities companies must be at least 50 per cent of the purchase price.

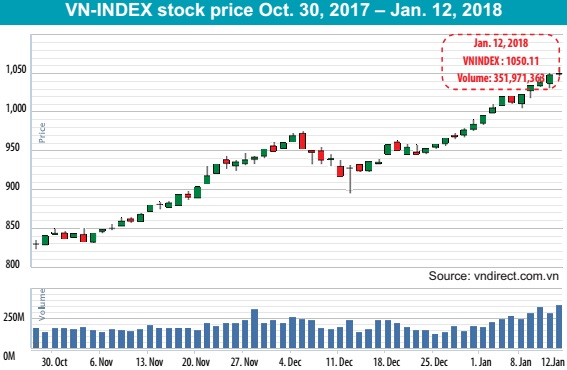

Concerns over the possibility of the draft policy being passed and soon taking effect were among major effects to hit the stock market last week.

SSC Chairman Tran Van Dung, however, told online newspaper bizlive.vn that the draft policy would not negatively affect the stock market.

The margin ratio of 60:40 (investors have to deposit 60 per cent of the purchase price and are allowed to borrow the remaining 40 per cent from the broker) was previously applied in 2013. But then the Viet Nam’s securities market regulators decided to adjust the ratio to 50:50, with the aim of enhancing market liquidity to allow investors to borrow more from brokers.

“As the stock market has now become stable, we should go back to the old ratio of 60:40, which will support sustainable growth of the stock market and strengthen risk-management capacities of securities companies,” Dung said.

According to Viet Dragon Securities Co (VDSC), the amendment on margin lending has both positive and negative effects on the market.

Margin lending helps increase the flows of capital into the stock market. The raise of initial margin ratio may be a way to cool down the credit growth in the banking-financial sector, following a lower growth target of 17 per cent in 2018 as set out by the State bank, VDSC said.

However, the slowdown in credit growth will probably affect the growth of the VN-Index, VDSC said.

Although the new proposal has not been approved, it has raised public concerns that the cash-flow into the stock market will be squeezed, thereby affecting the growing momentum of the stock market, according to HCM Securities Corp (HSC).

In its report, HSC says that the new proposal of SSC will reduce the investors’ borrowing demand due to their weaker ability to deposit at brokerages.

However, it will not significantly affect the total value of margin loans within securities companies, HSC said.

Notably, the SSC’s decision will also strongly affect stock codes that subject to the margin ratio of 50:50, it added.

Saigon Securities Incorporation (SSI) currently has 60 stock codes subjected to the margin ratio of 50:50. At HSC, 65 out of 170 stock codes borrowed under this rate.

At Viet Capital Securities Co (VCSC), only 25 stock codes were offered at this ratio. At other brokerages, such as ACBS, VNDirect, and FPTS, the numbers are 38, 60 and 85 codes, respectively.

Brokers MBS and BSC have the highest numbers of stock codes - 105 and 158 -offered at the margin ratio of 50:50. HSC forecasts that those stock codes would face selling pressure as investors have to urgently sell more stocks to offset their loans due to the new amendment, getting back to the margin status of 60:40.

At the end of 2017, the total loan margin in the market was estimated at VND38 trillion (US$1.67 billion), equal to 1 per cent of Viet Nam’s total value of stock market capitalisation.